Today, U.S. third-quarter GDP figure will be released at 12:30 GMT.

This is the first flash reading of the second quarter GDP of the United States. This would be a very vital piece of an economic docket to assess the health of the economy. This will be an indicator to see how the US economy is fairing under the Trump administration which reduced regulations and passed much-anticipated tax cuts and reforms but triggered uncertainties over global trade.

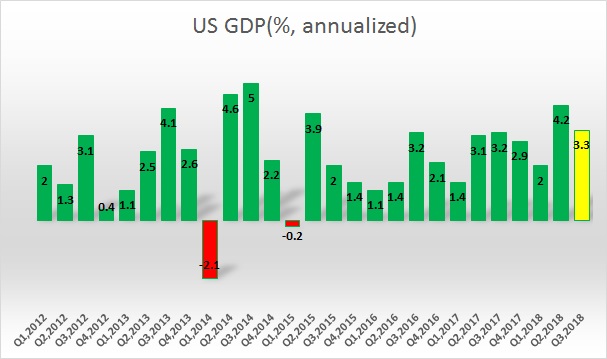

Past trends –

- U.S. GDP picked up pace since 2013 and increased pace in 2014. However, after rising 5 percentage and 2.2 percentage in the previous two quarters, U.S. GDP shrank by -0.2 percentage in the first quarter of 2015. Historically speaking U.S. economy usually falters in the first quarter.

- The second quarter was relatively better, with GDP growing at 2.1 percentage in the second quarter from the first, only to slow down in the third quarter, with GDP growing about 1.3 percentage.

- Final quarter GDP was much better than expected at 1.4 percentage, still meager compared to 2014.

- GDP grew by 1.1 percent in the first quarter of 2016 and the second quarter GDP grew by 1.4 percent and finished the year with 3.5 percent and 2.1 percent growth in the third and fourth quarter.

- In the first two quarters of 2017, GDP grew by 1.4 percent and by 3.1 percent. GDP grew by 3.2 percent in the third quarter.

- The growth has really picked up in 2018. See chart for details

Expectation today –

- GDP is expected at 3.3 percent y/y, much lower than the 4.2 percent in the last quarter.

- According to the latest calculations made yesterday, Atlanta Fed’s ‘GDP Now’ model is projecting 3.6 percent annualized growth in the third quarter.

Market impact –

If the actual number comes in line with the expectations, it would be considered quite well and would help in restoring further confidence in the US economy but if that fails to impress and drops below 3 percent (Unlikely), the dollar might take a big hit to the downside, along with U.S. equities, which have been experiencing sharp selling over the last three weeks.

The dollar index is currently trading at 96.75, up 0.8 percent for the day, so far. The dollar index is up almost 5 percent this year. The U.S. benchmark stock index, S&P500 is currently trading at 2660 area. The index gave up all the gains for the year by declining almost 9 percent in last one month and now down half a percent for the year. Weaker economic data from the U.S. would lead to a further selloff in the index.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022