Today first flash reading of U.S. third-quarter GDP will be released at 12:30 GMT.

This is the first flash reading of the third quarter GDP of the United States. This would be a very vital piece of an economic docket to assess the health of the economy. In recent days, concerns have surfaced that the economy could face recession in the next 12 months. JPMorgan has estimated that there are one in three chances that the economy would face a recession next year. New York Fed’s recession indicator has reached the highest point since the 2008/09 crisis. At this point, a strong figure is very much needed to restore confidence and in the absence of which, risk aversion might hit the financial markets.

Past trends –

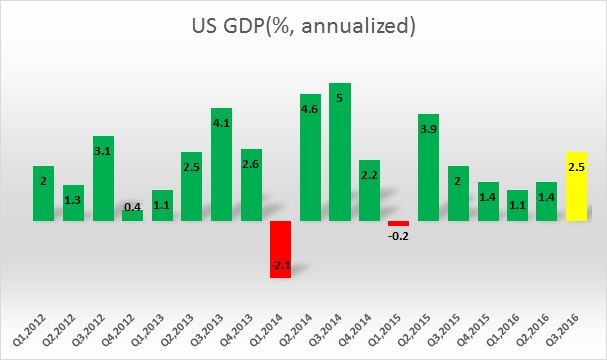

- U.S. GDP picked up pace since 2013 and increased pace in 2014. However, after rising 5 percentage and 2.2 percentage in previous two-quarters, U.S. GDP shrank by -0.1 percentage in the first quarter of 2015. Historically speaking U.S. economy usually, falters in the first quarter.

- The second quarter was relatively better, with GDP growing at 2.1 percentage in the second quarter from the first.

- Growth has slowed further in third quarter, with GDP growing about 1.3 percentage.

- Final quarter GDP was much better than expected at 1.4 percentage, still meager compared to 2014.

- GDP grew by 1.1 percent in the first quarter of 2016 and the second quarter GDP grew by 1.4 percent.

Expectation today –

- It is expected on the upper side today. According to median estimate, the economy is expected to grow by 2.5 percent in the third quarter.

Market impact –

If the actual number comes in line with the expectations, it would be considered very good and would help in restoring confidence in the economy but if that fails to impress and drops below 1.5 percent, the dollar might take a hit to the downside.

The dollar index, which is the value of the dollar against a basket of currencies is currently trading at 98.8, down 0.12 percent today so far.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX