What drives stocks (other than cheap funding from FED), is their earnings, some which investors get returned in form of dividends and buybacks, rest of which goes into the books as reserves. And what drives earnings higher is actual sales and to some extent the efficiency.

Now US Federal Reserve has raised interest rates three times since the financial crisis, signaling that extraordinary monetary stimulus is coming to an end (no matter how gradual). So it would be now up to the economy and moreover revenue and earnings to support growth in the stock market.

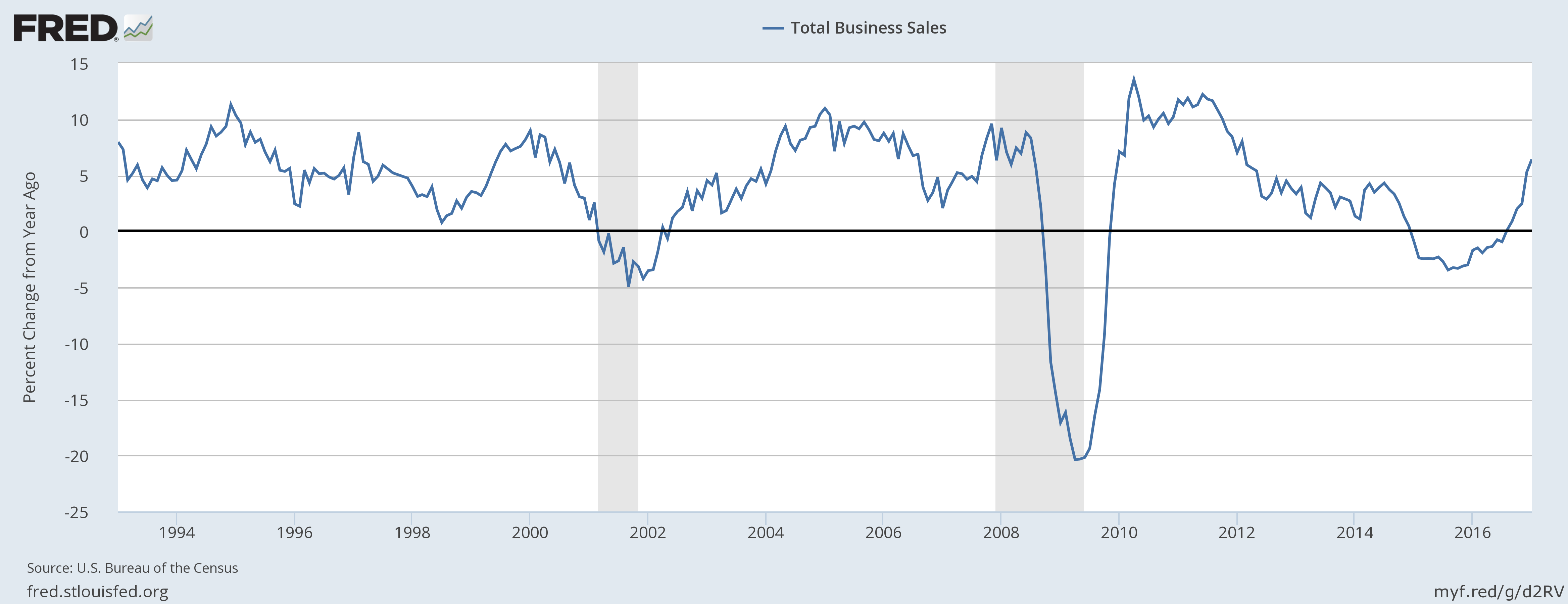

The recent data suggests that sales growth has been very encouraging and would help stocks race higher if that continues.

We expressed our concern last year as the growth dived into the negative and warned that it has well served as an indicator for looming recession in the past. However, since August last year, growth has returned to positive territory and since the US election outcome, it has just raced higher. This can be seen as a first ever change in direction since the rebound after the Great Recession. In January 2017, total business sales grew by 6.41 percent, the highest reading since February 2012. This is an early indication that the recent improvements in the soft data such as confidence are likely to be followed by hard data improvements.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record