Despite market optimism being reflected through the stock market rise, the trade war initiated by the U.S. President Donald Trump continues under the rug. Since President Trump announced 25 percent tariffs on all steel imports and 10 percent tariffs on all Aluminum imports, several countries like India, Mexico, China, and Russia have announced countermeasures. The European Union has also joined in the war by announcing retaliatory tariffs on U.S. imports. In addition to that, both China and the United States have announced a 25 percent tariff on imports worth $50 billion, with more to follow.

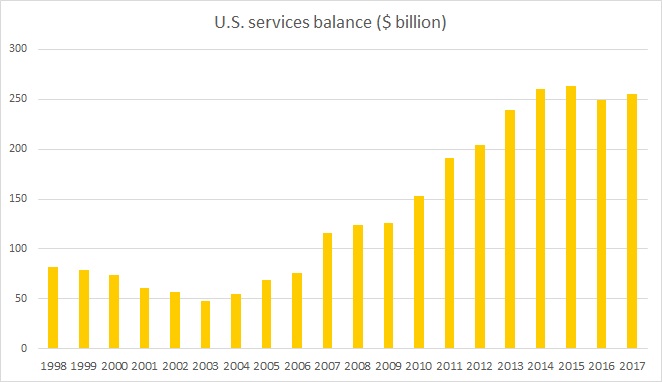

So far, the tariffs have largely be announced on goods. However, with the United States running $550 billion goods deficit with the rest of the world, the foreign retaliation could soon target U.S. services, where the U.S. enjoys a sizable surplus. During her speech at Bundestag, German Chancellor Angela Merkel has raised this point several times since the onset of the trade war.

The chart shows the U.S. services balance with the rest of the world. According to data from the census bureau, the U.S. services surplus with rest of the world was $255.2 billion in 2017.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record