Canadian retail sales data and CPI numbers will draw attention in the dollar bloc following the 0.8% slump in USD/CAD yesterday.

We think headline CPI is expected to remain unchanged at 0.8% YoY terms in May while April retail sales (ex autos) are forecast to have gained 0.3% MoM.

Key support for USD/CAD could be tested at 1.1955 levels. We observed some buying interest seen in this pair as hammer pattern candlestick occurred yesterday on downswing rallies where Stochastic signaled oversold pressure (%D line oscillating at 18.1680 & while %K line at 24.3516).

From last three days bearish divergence is on 14 day RSI trending at 43.7318.

We see implied volatility of 1M options on dollar trading at 6.4% as per Federal Resrve Bank of New York.

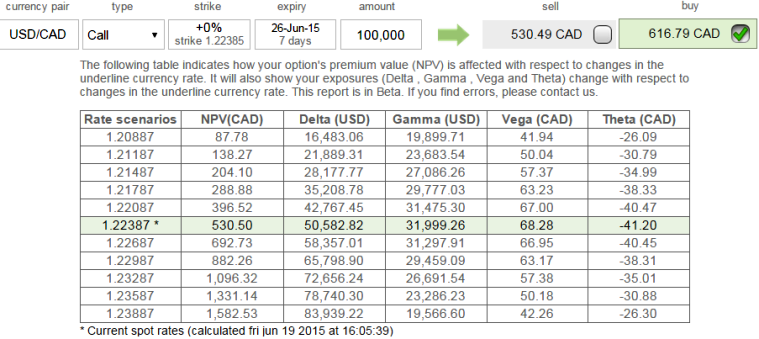

As stated in the figure delta of the At-The-Money USD/CAD call option is at 0.5 which means equivalent underlying spot outright would be USD 50000.

Vega of the instrument is 68.28, so for every change 6.4% change in underlying change would evidence USD 436.99 in option pricing which we have not noticed in recent past.

So we recommend current ATM USD/CAD calls which are overpriced are to be avoided.

USD/CAD IV signifies calls overpriced

Friday, June 19, 2015 10:51 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?