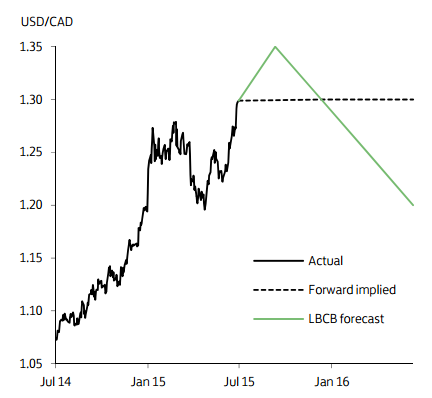

The BoC's decision to cut its official rate by 25bp to 0.5% at its 15 July policy meeting pushed USD/CAD to a new 6-year high of 1.2959. The cut occurred against the backdrop of a continued weakening in both commodity prices and the Canadian economy. It was clear from the BoC's accompanying statement that it was particularly concerned about the impact of weaker oil prices and the subdued growth in non-energy exports to the US.

Investment intentions among Canadian resource-related companies have dropped by up to 40% over the past few months, while mining output has contracted by over 6% in the past year. Technically, the 2009 high of 1.3065 is likely to act as near-term resistance and, above that, 1.34/1.35.

"With US interest rates expected to rise in H2 and growth differentials firming in the US's favour, we target a move in USD/CAD above 1.30 by end Q3. We are wary, however, that positioning leaves the CAD vulnerable to a potential short squeeze. Further out, we look for CAD to firm in line with AUD, supported by a recovery in western growth and commodity prices," says Lloyds Bank.

USD/CAD Outlook

Monday, July 20, 2015 9:27 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX