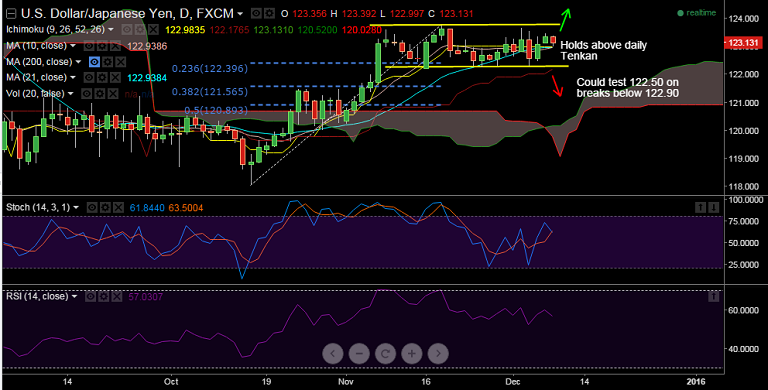

- USD/JPY spot remains contained by 122.26-123.77 2/3 week range, repeated failures below 122.40 which is 23.6% Fib retrace of 118.07-123.77 rise means bias marginally on upside.

- China trade data-led risk-off supported the Japanese Yen higher, which snaped losses and edged higher against USD.

- China trade balance came in at ($54.1B, below expectations at $63.3B in November. Exports declined more than previous, coming at -3.7% against a -2.9% drop expected. Dismal data refuelled concerns over the health of China's economy.

- USD/JPY fell as low as 122.99, but downside found support by daily Tenkan at 122.99, the pair has pared losses to currently trade at 123.07.

- Daily Techs point South, breaks below 122.90 could see further falls which could provide good entry points. We would wait for dips to go long.

R1: 123.56 (Daily High Dec 3)

R2: 123.68 (Daily High Dec 2)

R3: 123.77 (Daily High Nov 18)

Support Levels:

S1: 122.99 (Tenkan-Sen)

S2: 122.48 (Daily Low Dec 4)

S3: 122.30 (Daily Low Dec 3)

FxWirePro- Major European Indices

FxWirePro- Major European Indices  Pound Powerhouse: GBPJPY Smashes 211.50 as Yen Weakness Intensifies

Pound Powerhouse: GBPJPY Smashes 211.50 as Yen Weakness Intensifies  FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro: EUR/ NZD stuck in range but maintains bearish bias

FxWirePro: EUR/ NZD stuck in range but maintains bearish bias  FxWirePro: USD/JPY remains buoyant, looks to extend gains

FxWirePro: USD/JPY remains buoyant, looks to extend gains  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/NZD topside capped, sellers still hold the advantage

FxWirePro: GBP/NZD topside capped, sellers still hold the advantage  Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades

Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?

ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: AUD/USD downside pressure persists as risk aversion reigns

FxWirePro: AUD/USD downside pressure persists as risk aversion reigns  Bitcoin Buffeted by Oil Surge: BTCUSD Eyes USD 80,000 Recovery Amid Volatility

Bitcoin Buffeted by Oil Surge: BTCUSD Eyes USD 80,000 Recovery Amid Volatility  G7 Oil Blitz Ignites Ethereum Recovery: ETHUSD Reclaims USD 2,000 Threshold

G7 Oil Blitz Ignites Ethereum Recovery: ETHUSD Reclaims USD 2,000 Threshold  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)