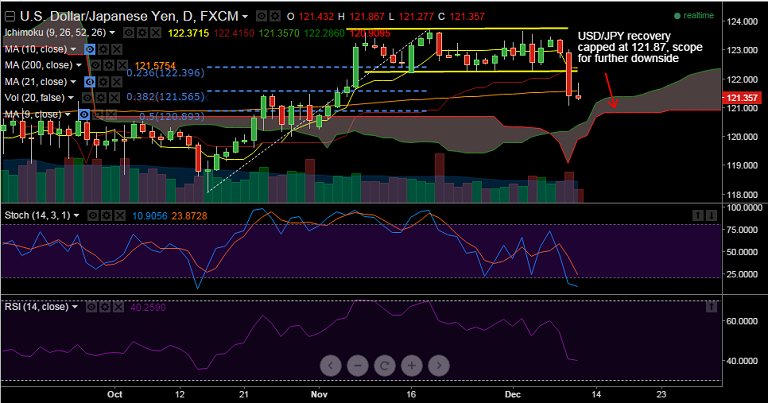

USD/JPY posting a modest recovery from an almost 200 pips slump in Wednesday's trade. The pair broke below 200 DMA and 38.2% of the Oct-Nov rise at 121.56.

- Upward revision to Japan Q3 real GDP and the machinery orders data released yesterday suggest that the BOJ can persist with its current stance for now, and the Yen remained supported by the reduced BOJ easing expectations.

- Bargain-hunting at lows and option-related buys saw a bounce to 121.87, but price was rejected at highs and the pair is now back to 121.53.

- Current slide may extend upto daily Cloud, pair could test prior lows in 120.00 levels, with 121.27 (Session lows) initial support, 121.57 (200-DMA) resistance.

- Beyond that there is limited scope for further yen weakness, and going into the FOMC meeting next week means USD/JPY is likely to remain well supported.

- For now we find it good to sell rallies around 121.80, SL: 122.40, TP1: 121.10, TP2: 120.90

Resistance Levels:

R1: 121.57 (200-DMA)

R2: 121.60 (Daily High Oct 26)

R3: 123.05 (Session High Dec 9)

Support Levels:

S1: 121.27 (Session lows Dec 10)

S2: 121.00 (Daily Low Nov 4)

S3: 120.92 (50% 118.07-123.77 rise)

FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/NZD down trend loses steam, remains on bearish path

FxWirePro: GBP/NZD down trend loses steam, remains on bearish path  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Aussie-Yen Deadlock: AUDJPY Braces for Potential Breakout Toward 112

Aussie-Yen Deadlock: AUDJPY Braces for Potential Breakout Toward 112  FxWirePro: AUD/USD firms as demand for the U.S. dollar eases

FxWirePro: AUD/USD firms as demand for the U.S. dollar eases  FxWirePro:NZD/USD under pressure as Middle East war escalates

FxWirePro:NZD/USD under pressure as Middle East war escalates  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  FxWirePro: USD/JPY remains buoyant, looks to extend gains

FxWirePro: USD/JPY remains buoyant, looks to extend gains  Bitcoin Buffeted by Oil Surge: BTCUSD Eyes USD 80,000 Recovery Amid Volatility

Bitcoin Buffeted by Oil Surge: BTCUSD Eyes USD 80,000 Recovery Amid Volatility  Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades

Kiwi Bulls Charge: NZDJPY Targets 94 as Yen Momentum Fades  ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?

ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?  NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push

Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push  FxWirePro- Major European Indices

FxWirePro- Major European Indices