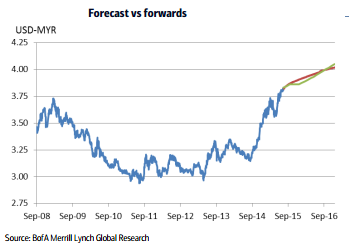

Malaysia reported a considerable decline of USD5bn (USD105.5bn to 100.5bn) in FX reserves for the first two weeks of July. The country's currency is under pressure, therefore, Bank of America revises its estimate and expects USD/MYR at 3.86 for end 3Q and end-4Q, and by the end 2016 it would be at 4.05. The bank assumes, the BNM should let the currency go and not deplete its reserves simply because the lower the number, the more vulnerable the currency gets. Apart from increases noises on the domestic front, the external picture is also not going Ringgit's way.

Oil has started to drop again. Weakness in LNG exports due to the previous decline in oil prices have only started to show up in Malaysia exports. So in that sense, the recent decline in oil prices will only exacerbate the move, says Bank of America.

USD/MYR likely to reach 4.05 by end-2016

Thursday, August 6, 2015 6:27 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022