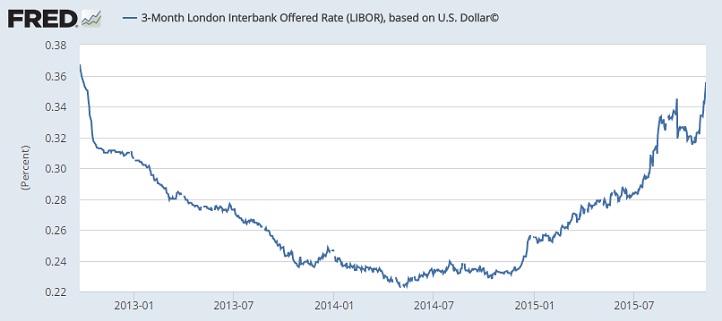

Rate hike expectation are now firmer than ever as Dollar denominated rates are clearly on the rise and at quite a fast pace. Libor or the London interbank offered rate, has reached highest level, since September 2012.

Data showed, since October meeting rates have really firmed up. Libor which was still declining while FED wind up its asset purchase during 2014. This year it has clearly been on the rise. Rates have firmed almost 16 basis points since last December. It may sound not much, but considering latest trend and level of interest rates in advanced economies, it's quite a lot. Almost 80% rise in less than 12 months.

If Dollar denominated Libor do keep rising, and keep diverging from interest rates in other currencies there could be more upside to Dollar.

To start off this week, Dollar is quite strong against commodities as well as currencies.

FXCM US Dollar index is up 0.3% today so far, trading at 12185.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate