Since Bank of England (BOE) published its inflation report, suggesting no hike required from BOE in 2016, to keep inflation in check, pound has been struggling. After last week's dovish monetary policy statement, it's even struggling to clear 1.52 resistance area.

Last night, stronger Dollar ahead of FOMC, just pushed pound few pips away from 1.5 support area.

ILO unemployment reading to publish around 9:30 GMT today.

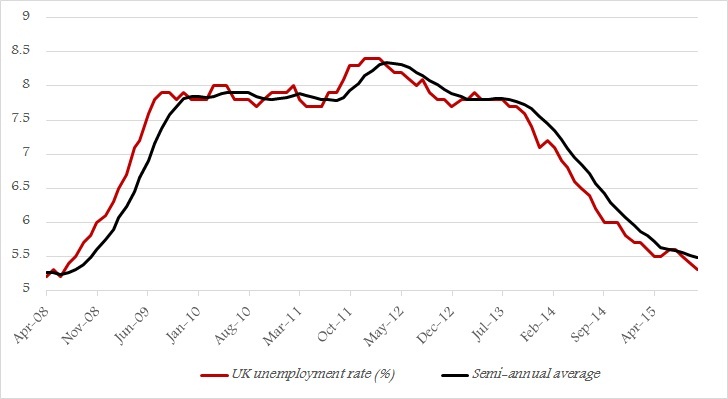

- As of now unemployment rate in UK stands at 5.3% and median estimate says it will remain so in today's reading.

- Once again major focus will be on earnings growth, since BOE policymakers in several instances announced they will be looking at wage growth component and current rate is not sufficient to generate targeted inflation. This component has gained sharply since last year, however slowed down somewhat in recent reading. In three months to September, average earnings excluding bonus rose by 2.5%, lower than 2.9% seen in July.

- Today market is expecting slowdown further in earnings growth at 2.3% excluding bonus but to grow 2.5% including it.

Impact -

- Data, coming as expected, may not be very bullish for Pound as Bank of England (BOE) mentioned that current wage growth is not sufficient to give a rise in inflation.

- However any wage growth below 2.3% likely to sour sentiment.

- With better report, expect Pound to have better sentiment heading into FOMC.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX