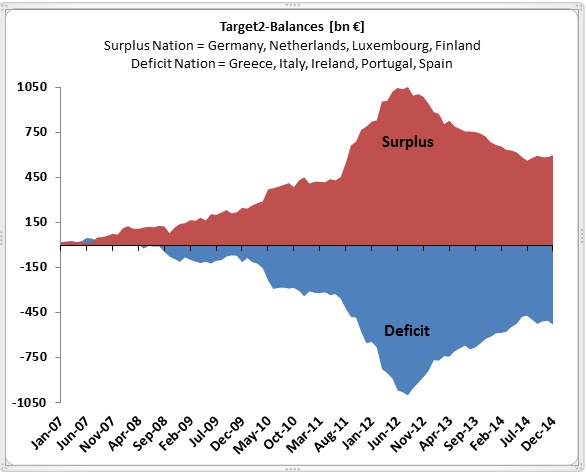

Chart is attached showing Euro zone Target 2 balance.

What is TARGET2?

- Target 2 is a real time gross settlement system to support payments with unlimited credit facility and no upper limit on transactions. It is used by countries within European countries for payments of transfer of good and services across nations.

- For example - a Greek importer might place an order with a German company. Payments are channeled via national central banks. So the German exporter gets a credit with Bundesbank which in turn has claims on ECB and the importer owes money to Bank of Greece.

Why bother?

- Since 2008 crisis countries like Germany, Netherlands, Luxemburg and Finland started experiencing massive surplus against countries like Greece, Spain, Italy, Ireland etc.

- In just three years, imbalances as measured in TARGET2 rose from below € 50 billion to more than € 1 trillion. Most was shared by Germany. In other words Germany was providing free loans to peripheral countries who might not have the capability to pay back.

Issues -

- In a single monetary union currency depreciation is not possible so interest rate spiked. Only option left was to deflate individual companies to improve competitive advantage. Hence austerity.

- Since 2012, after measures taken Target 2 imbalance fell to below € 500 billion by February 2014. However from latter half of the year it started deteriorating again.

Analogy -

- Should the Euro zone break Germany has a lot to lose.

- Countries have not fully utilized the time provided by OMT from ECB.

- Now there is quantitative easing. Countries and companies are having a good time doing business with rest of the world, as Euro remain depressed. Countries need to utilize the time intelligently.

- Even if deficit countries pay back the credit with new found resources, structural issues would remain unsolved. Hence austerity is must should the Euro to stay long term.

- Nevertheless Investors' faith is restoredfor now towards Euro zone, however structural and integrity issues are required to be solved for long term stability.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings