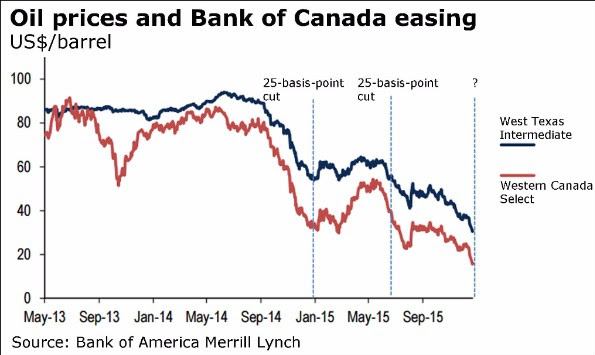

The Bank of Canada has stated that the additional decline in oil prices has setback the Canadian economy for a temporary period of time. According to the central bank, the economy's return to above-potential growth will now be delayed until Q2 2016. BoC forecasts the economy to expand by around 1.5% in 2016 and 2.5% in 2017. It anticipates the output gap closing around late 2017. The central bank has not included in its forecast the positive effect of fiscal measures anticipated in the next federal budget.

However, according to Dominion Lending Centres analyst, suggesting that the weakness at present is because of temporary factors and that a recovery is in progress without fiscal stimulus lacks credibility.

"Oil prices are not falling due to temporary factors. The world is adjusting to an alternate reality where oil supply is well in excess of sustainable demand and more supply is coming on stream from Iran", says analyst at Dominion Lending Centres.

Canadian oil is one of the most expensive to produce globally. As shown in the chart, Canadian oil producers are receiving much lower prices as compared with prices elsewhere. This certainly continues the restructuring in the oil patch. Since the start of the fall in oil prices in 2014, the BoC has been revising its economic growth forecast downwards in each quarterly Monetary Policy Report.

Weakness in Canadian economy due to oil price rout temporary?

Thursday, January 21, 2016 5:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed