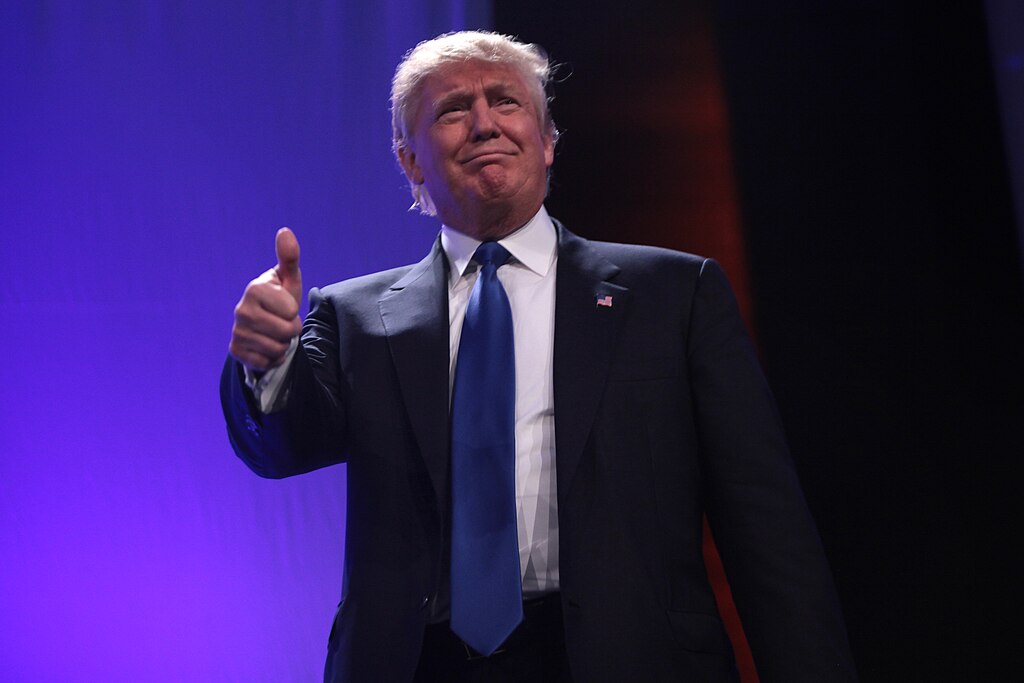

In 2025, President Donald Trump has launched an aggressive campaign to combat financial fraud, introducing policies aimed at protecting consumers and restoring trust in financial institutions. His administration’s efforts focus on tightening regulations, increasing oversight, and holding corporations accountable for deceptive practices.

As financial crimes continue to pose significant risks to the U.S. economy, Trump’s measures seek to address vulnerabilities that undermine public confidence and erode economic stability. However, critics argue that his approach may face challenges in implementation and enforcement.

Key Policies in the Fight Against Financial Fraud

Trump’s administration has unveiled several initiatives aimed at preventing financial fraud:

-

Strengthened Oversight: The administration plans to expand the powers of regulatory agencies like the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN). These agencies will receive additional funding and personnel to enhance their monitoring capabilities.

-

Corporate Accountability: Trump has called for harsher penalties for companies and executives found guilty of fraud, including increased fines and potential imprisonment for repeat offenders.

-

Consumer Protection Reforms: A significant focus is placed on safeguarding consumers from predatory lending, identity theft, and Ponzi schemes. This includes mandating greater transparency in financial products and services.

-

Whistleblower Incentives: The administration has proposed higher monetary rewards for whistleblowers who expose corporate malpractices, aiming to encourage more individuals to report wrongdoing.

-

Digital Asset Regulation: Recognizing the rise of cryptocurrency-related fraud, the administration plans to regulate digital assets more rigorously, targeting scams and unregistered securities.

In a recent speech, Trump stated that his administration is “committed to eradicating fraud at every level” and ensuring that financial institutions operate with integrity. However, some financial experts warn that these initiatives could face resistance from industry lobbyists and legal hurdles.

Mixed Reactions to Trump’s Financial Fraud Crackdown

Public reactions to Trump’s anti-fraud measures have been divided, with supporters praising the reforms and critics questioning their feasibility. Social media has become a battleground for opinions on the issue:

- @ConsumerAdvocate2025: “Finally, real action against financial fraud! Let’s hope this isn’t just talk—America needs accountability.”

- @FinanceWatchdog: “Whistleblower incentives are great, but will Wall Street really be held accountable? Doubtful!”

- @CryptoEnthusiast: “Regulating digital assets is necessary, but let’s not stifle innovation in the process.”

- @LegalEagleXX: “Trump’s plan sounds ambitious, but enforcement will be the real challenge. Will regulators have enough power?”

- @MainStreetVoice: “Protecting consumers from predatory lenders is long overdue. Excited to see how this plays out!”

- @SkepticNow: “More oversight usually means more bureaucracy. Will this actually stop fraud or just slow the system down?”

Can Trump’s Policies Deliver Results?

While Trump’s initiatives mark a bold stance against financial fraud, their success will depend on effective enforcement and bipartisan support. Skeptics argue that the financial sector’s complex nature and powerful influence could hinder meaningful reform. Nevertheless, the administration’s focus on protecting consumers and increasing accountability has resonated with many Americans.

Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East

Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East  Middle East Conflict Escalates After Khamenei’s Death as U.S., Israel and Iran Exchange Strikes

Middle East Conflict Escalates After Khamenei’s Death as U.S., Israel and Iran Exchange Strikes  Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates

Trump Announces U.S. Strikes on Iran Navy as Conflict Escalates  Marco Rubio to Brief Congress After U.S.-Israeli Strikes on Iran

Marco Rubio to Brief Congress After U.S.-Israeli Strikes on Iran  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Netanyahu Suggests Iran’s Supreme Leader Khamenei May Have Been Killed in Israeli-U.S. Strikes

Netanyahu Suggests Iran’s Supreme Leader Khamenei May Have Been Killed in Israeli-U.S. Strikes  Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei

Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei  Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes

Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes  UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles

UK Accepts U.S. Request to Use British Bases for Defensive Strikes on Iranian Missiles  EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption

EU Urges Maximum Restraint in Iran Conflict Amid Fears of Regional Escalation and Oil Supply Disruption  Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met

Trump Says U.S. Combat Operations in Iran Will Continue Until Objectives Are Met  U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed

U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties

Trump Says U.S. Attacks on Iran Will Continue, Warns of More American Casualties  Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott

Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott  Supreme Court Backs GOP Lawmaker in New York Redistricting Fight Ahead of Midterms

Supreme Court Backs GOP Lawmaker in New York Redistricting Fight Ahead of Midterms