You ask the question, what’s been pulling the Dollar up? And you will have the answer to the above question, provided you get the first one right.

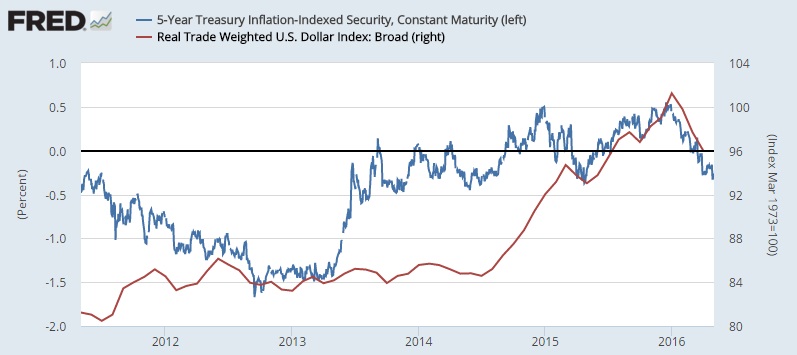

Yes, it the interest rates and happenings related to interest rates, no matter how you express it. You can say FED policy wind up, policy divergence, or rate hike expectations but underlying remains the same its interest rate and the above chart explains it all.

Since mid, 2013 to December 2014, U.S. real interest rates rose around 2%. Though U.S. Dollar initially ignored this sharp rise but as FED purchase neared full wind up, traders woke up and Dollar sharply adjusted to the real rates and since then these two have been good friends, rising to gather, falling togather.

After FED hikes rates in last December, real interest rate touched highest level of 0.5% and Dollar (Real trade weighted U.S. Dollar index) touched its high around 101.2, and both has been falling since.

So, why this recent weakness all of a sudden if rates and Dollar was dropping steadily since December FED meeting?

While the rates declined, it was broadly positive until March, but it dropped to negative for first time since June, last year.

Unless the rates recover, we don’t expect Dollar to regain its groove.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed