Predicting central bank policy starts with looking at the 'distance' between policy targets and current states. After years of debating the appropriateness of explicitly defining the inflation target, the BOJ finally entered a new regime of inflation targeting at 2% in January 2013. Two months later, under new Governor Haruhiko Kuroda's leadership, the BOJ embarked on a large scale QQE program, aiming to achieve the target roughly within two years.

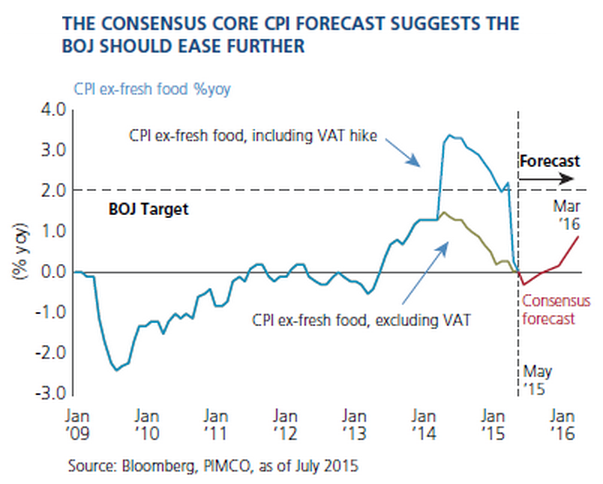

Inflation rates, measured here as CPI excluding fresh food (called Japan's core CPI), responded to the BOJ's QQE and rose to 3.4% year over year in May 2014 but then fell to 0.1% a year later despite the bank's surprise additional easing in October 2014. Though much of the large swing in core CPI can be attributed to oil prices and a 3-percentage-point increase of consumption tax (VAT) rates in April 2014, underlying inflation also remains weak.

Based on the seemingly long distance from the current inflation rate to the target level of 2%, one could simply argue that the BOJ should ease more. The forecasted inflation rate also suggests so; the consensus forecast for core CPI is about 1.0% a year from now, which is reasonable yet is well below the target.

Where are we relative to the BOJ’s 2% inflation target?

Tuesday, July 21, 2015 11:12 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX