From April last to mid-May there was rout in bond market, mainly European bond market which saw German 10 year yield jumped from 0.05% to 0.75% taking the Euro along. Euro touched as high as 1.145 against dollar, up from 1.05 in March.

However Euro has diverged itself from 10 year bund yield. When ECB officials suggested front loading of purchase bund 10 year yield remained overall resilient while Euro dropped towards 1.11.

Euro dropped further towards 1.097 as core CPI improved in US in April, more than what market was expecting.

Why can't bund yields provide support to Euro?

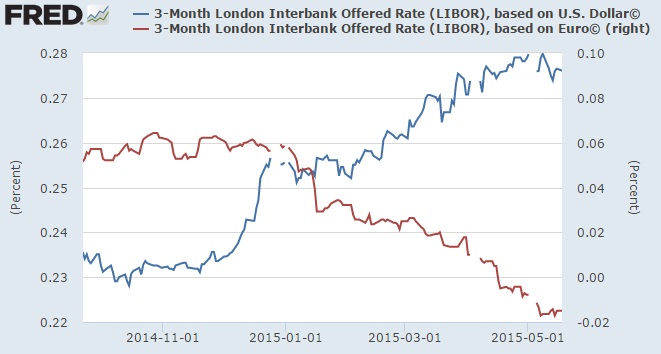

- While 10 year bund yield is maintain around 0.65%, short term yields remain well anchored to negative territory. Bund yields are still in negative up to 4 years, with two year hovering below -0.20%. Similarly Euro based 3 month libor is well into negative territory. In short term Euro remains a funding currency to capture interest rate differentials.

- Dollar leg of EUR/USD from might have recovered from its slump with dollar index breaking above downtrend and now hovering around 96.3, up from 93.3.

Euro is vulnerable to reach 1.065 area once again, if dollar leg succeed in coming back.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?