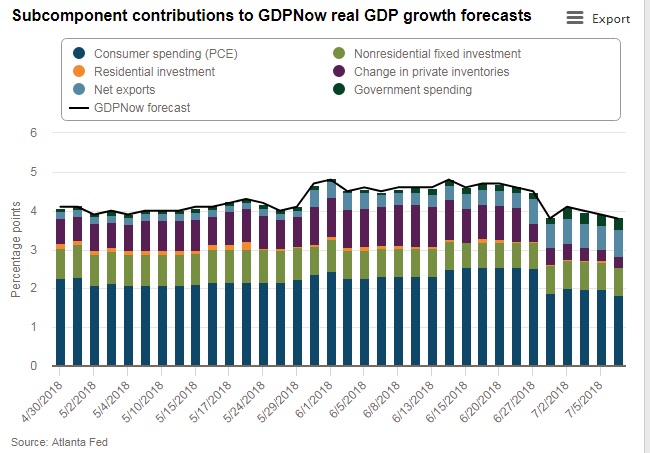

The ‘GDP Now’ data published by the Federal Reserve of Atlanta is posing some concerns over the health of the U.S. economy and more importantly, the effect of the current trade feud on the economy. In mid-June, Atlanta Fed’s GDP Now was forecasting a U.S. economic growth 4.8 percent in the second quarter of this year. It even prompted the Commerce Secretary Wilbur Ross in suggesting while speaking to CNBC that the growth rate will be over 3 percent on an annualized basis and even close to 4 percent.

However, since then the GDP Now has projected a sharp decline in growth. As of latest reading published last week, GDP Now is projecting 3.8 percent growth in the second quarter; not too impressive and most important, down almost a percent.

The major reasons for the slowdown have been a decline and in consumer spending growth and second-quarter real gross private domestic investment growth. Since mid-June, consumer spending has declined by 0.7 percent and private investment growth has slowed to just 6 percent from well over 7 percent.

It can be said that the uncertainties surrounding trade and tariffs are taking its toll on the economy.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound