Since December 2015, the U.S. Federal Reserve has hiked interest rates five times; three times in 2017 alone, which has pushed the short-term interest rates higher. However, the increase of the U.S. Federal funds rate as well as the short-term interest rates was not met with a similar increase in the long-term rates, which increases the risk of yield curve inversion.

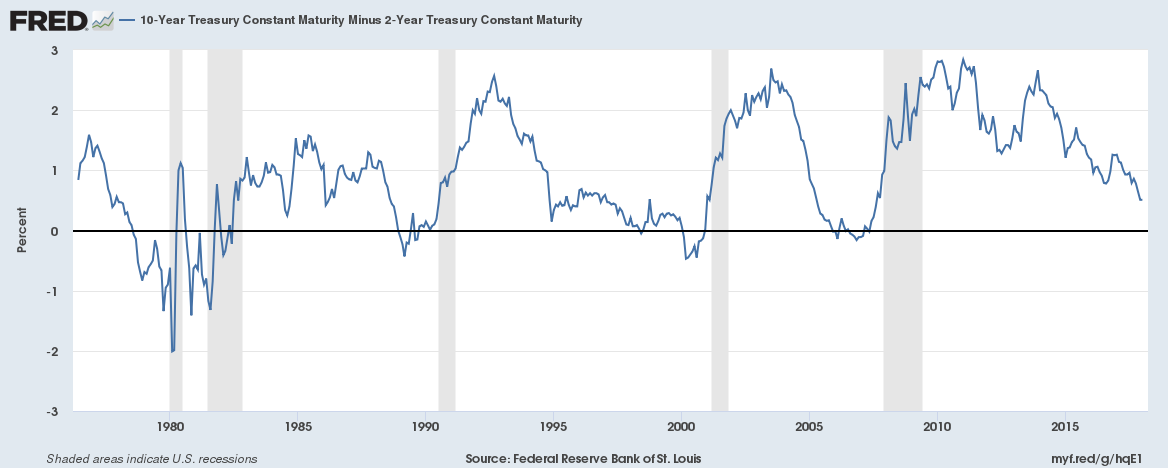

The above chart shows the difference between U.S. long-term rate (10-year) and short-term rate (2-year). The chart shows that the premium has fallen to just 51 basis points, which is the lowest level in more than a decade.

This is of high importance since the spread is widely accepted as one of the most reliable indicators of a coming recession. Every yield curve inversion was followed by a recession.

The U.S. Federal Reserve has announced plans for three more rate hikes in 2018 and if the long-term rates don’t start rising, such an increase would surely invert the yield curve.

Recently, Atlanta Fed President Raphael W. Bostic expressed similar worries.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.