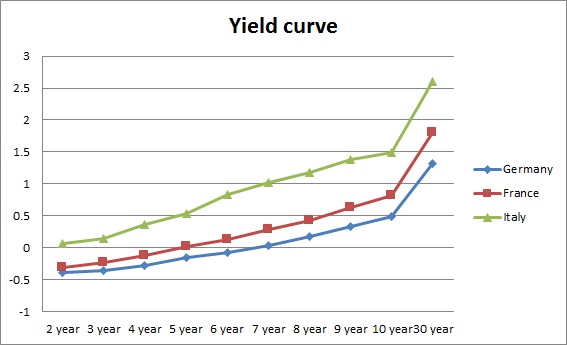

European bond are all merry heading into European Central Bank's (ECB), much awaited meeting on December 3rd. Yields are dropping fast, even touching record low.

- German 2year yield has dropped to record low after opening and now trading around 0.382%, more than 18 basis points below ECB's deposit rates. Yields are negative up to six years now, while up to four years they are below deposit rates. 10 year yield, over last few weeks has dropped by 22 basis points and further drop seem to be on the way as ECB will close in. German 10 year yield is currently at 0.481%.

- France is second largest economy and will have second largest share of bonds in ECB's portfolio. French yields are negative up to four years and under current deposit rates up to three years. French 10 year yield is currently trading at 0.81%

- Italy is third largest economy of Europe. Yields have come a long way since the debt crisis of 2011/12, when 10 year yield touched above 7%. Compared to that, 10 year is just at 1.49%. Yield curve is not into negative yet, however 2 year yield is more likely to fall into negative by from current 0.06%.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate