Yields are clearly on the rise today as investors have finally started to align with comments from Bank of England (BOE) governor Mark carney, according to whom BOE is likely to follow FED and hike rates.

- UK 2 year yield is up 3.7%, trading at 0.61%.

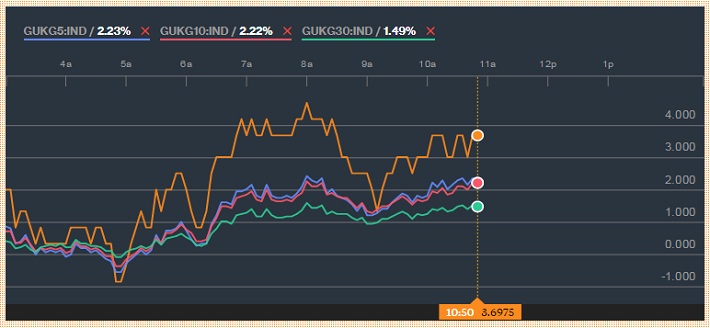

- UK 5 year yield is up 2.3%,trading at 1.51%

- UK 10 year yield is up 2.2%, trading at 1.98%.

- UK 30 year yield is up 1.5%, trading at 2.66%.

However there is no beating the US rates ahead of FOMC meeting, scheduled at 18:00 GMT.

- US 2 year yield is up 5.4% today, trading at 0.7%.

BOE rate hike outlook is clearly bullish for pound, however clear direction is likely to remain clouded by volatility, due to rate hike expectations from FED, as early as September this year.

Pound traded as high as 1.569 against dollar today, however retreated sharply over position sizing ahead of FOMC. Pound is currently trading at 1.563 against dollar.