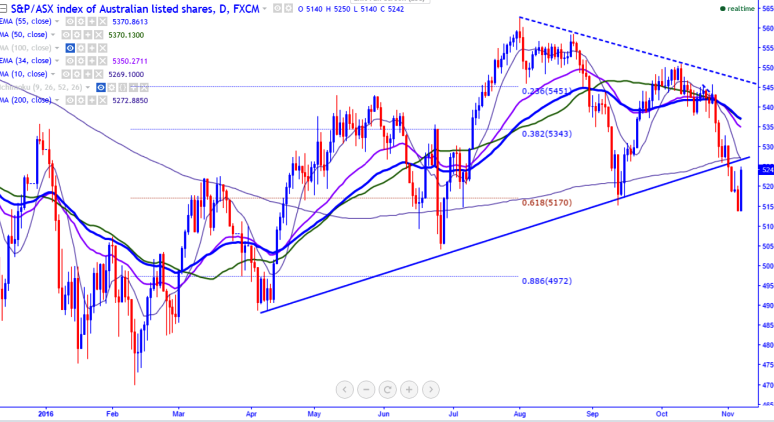

- Major support - 5150 (Sep 13th 2016 low)

- Minor intraday resistance - 5275 (200- day MA).

- The index jumped sharply till 5250 from the low of 5140 on account of clean chit by FBI on Hillary Clinton. It is currently trading around 5241.

- ASX200 faces major resistance at 10- day MA and it should close above that level for minor jump till 5300/5325.

- On the higher side, resistance is at 5275 (200- day MA) and any break above 5275 targets 5300/5325 (daily Tenken-Sen). The index should break above 5505 for further jump till 5625.

- The minor support is around 5150 and any break below targets 5100/5000 in the short term.

It is good to sell on rallies around 5230-40 with SL around 5280 for the TP of 5152/5100