Ahead of RBNZ’s monetary policy meeting that is scheduled next week, the market pricing for a November OCR cut has been stable during the past two weeks at around 80% (currently 86%).

Q3 CPI data was unsurprising to RBNZ forecasts, although it did surprise a number of analysts who expected something lower.

The markets have consistently priced in a greater than 50% chance of a November cut since Assistant Governor McDermott’s speech in September reminding all that the “promised” cut remains in the pipeline.

So what could spook them from cutting? A sharp rise in inflation expectations on 2 Nov (unlikely, given CPI is running at only 0.2%/yr), or a plunge in the NZD, come to mind. We continue to expect a cut on 10 Nov, followed by a lengthy pause.

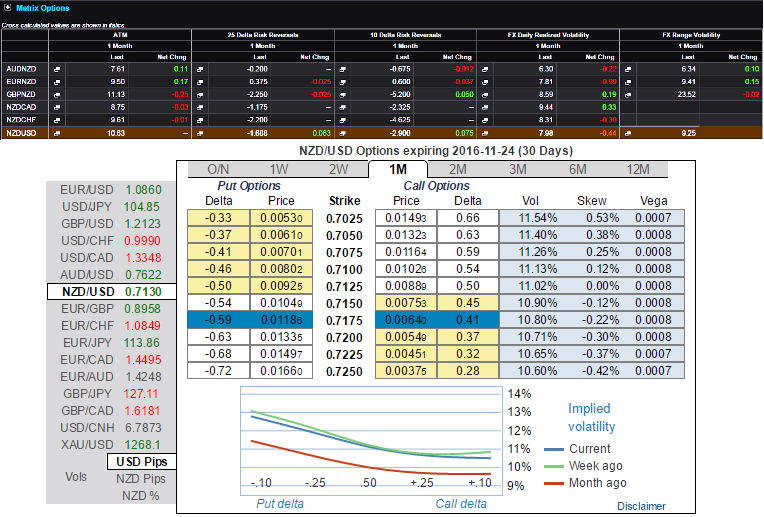

Consequently, the participants in NZD OTC market are getting active, 1m IVs are screaming off over 11.02% and positive skew is observed in OTM put strikes.

Implied volatility is elevated compared to realized volatility (see above nutshell), suggesting a structure selling it.

The downside skew is not sufficiently elevated to finance a put via low strikes (a put spread-like structure), but the negative skew is enough to obtain an attractive discount via a downside knock-out. Such a barrier is appropriate for trading moderate NZD/USD downside.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.