Arctos Partners has chosen to invest in Aston Martin’s Formula One team ahead of F1’s anticipated return to Las Vegas. This deal places a valuation of approximately £1 billion on the racing unit.

It also marked the first instance where team owner Lawrence Stroll has sought external investors for the F1 team he is associated with, according to the Financial Times.

Arctos Joins Holding Company of Aston Martin's F1 Team: AMR Holdings GP Limited

Reuters reported that this significant investment by Arctos entails the acquisition of a "minority shareholding" in AMR Holdings GP Limited, the holding company of Aston Martin's F1 team. While specific financial details were not disclosed, confidential sources suggest a £1 billion valuation for the team.

Arctos stands alongside Saudi Aramco as a partner of the team, while not holding a stake in the business. However, the state oil group assumes the option to purchase 10% of the unit in the future. Lawrence Stroll expressed his satisfaction with Arctos' involvement, highlighting their valuable industry insights. The Aston Martin team is now proud to join Arctos' esteemed portfolio of investments.

Arctos boasts an extensive sports portfolio, including ownership stakes in various sports such as football, basketball, and baseball. Notably, they hold a minority stake in Fenway Sports Group, the parent company of Liverpool Football Club and the Red Sox baseball team, solidifying their presence in the sports industry.

Arctos plans to provide substantial resources to enhance the team's brand and extend its reach, drawing from their extensive experience in sports management.

F1 Team Valuations Continue to Rise

The valuation of F1 teams has seen significant growth since Lawrence Stroll's acquisition of the team, originally known as Force India, before rebranding as Racing Point and ultimately becoming Aston Martin in 2021. In June, Renault's Alpine outfit achieved a valuation of approximately $900mn, following investments from RedBird Capital Partners, Otro Capital, and Hollywood actor Ryan Reynolds, resulting in a 24% stake.

Sir Jim Ratcliffe’s Ineos acquired a one-third stake in the Mercedes F1 team, totaling £208 million in January 2022. Dorilton, a US-based investment group, completed the acquisition of the Williams team for €152mn in August 2020. Additionally, McLaren sold a stake worth £560 million to MSP Sports Capital and other investors in December of the same year.

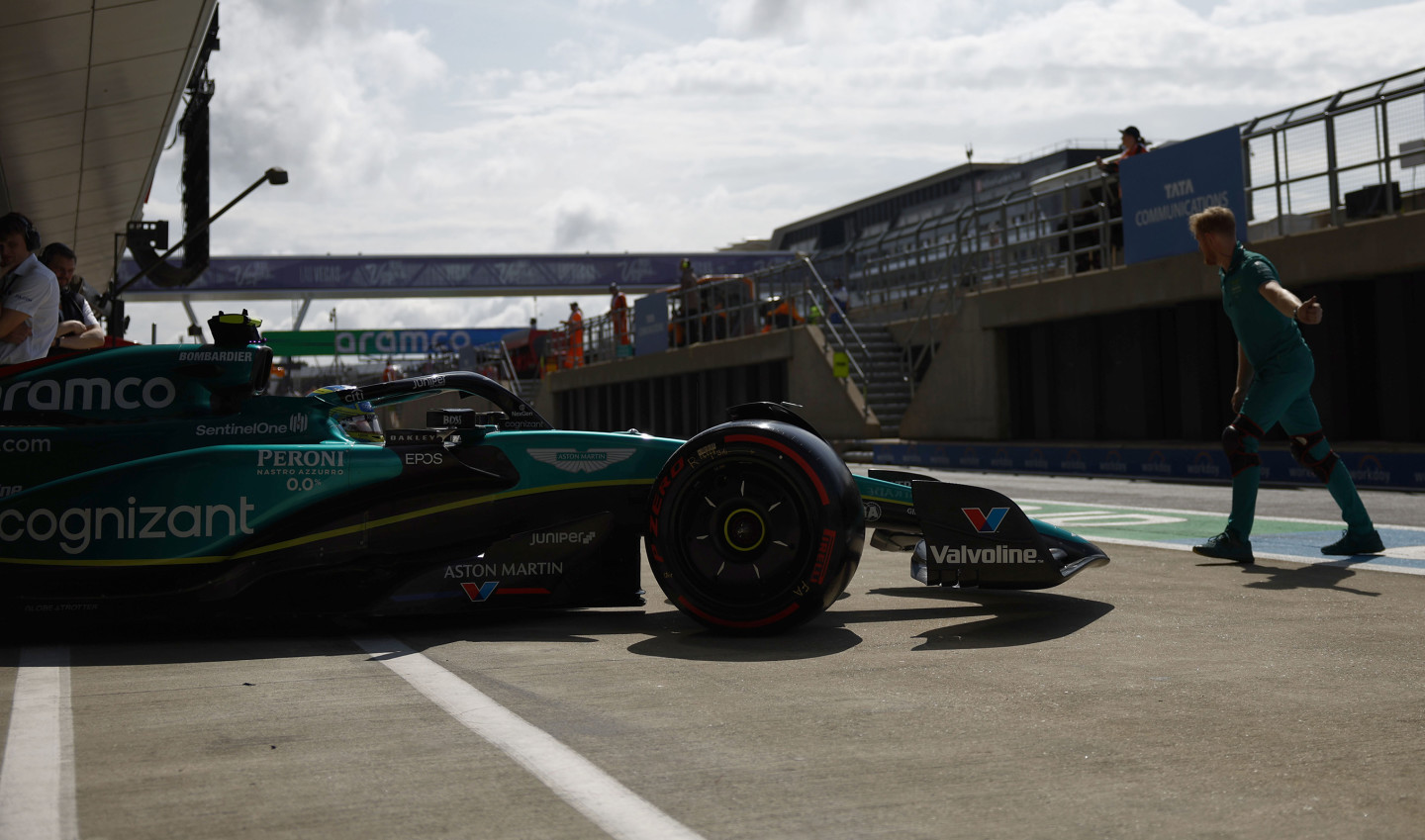

Photo: Aston Martin F1 Newsroom

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  US Reviewing Visa Denial for Venezuelan Little League Team Barred from World Series

US Reviewing Visa Denial for Venezuelan Little League Team Barred from World Series  Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient

Tech Stocks Rally in Asia-Pacific as Dollar Remains Resilient  Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  NBA Returns to China with Alibaba Partnership and Historic Macau Games

NBA Returns to China with Alibaba Partnership and Historic Macau Games  JD Vance to Lead U.S. Presidential Delegation at Milano Cortina Winter Olympics Opening Ceremony

JD Vance to Lead U.S. Presidential Delegation at Milano Cortina Winter Olympics Opening Ceremony  Extreme heat, flooding, wildfires – Colorado’s formerly incarcerated people on the hazards they faced behind bars

Extreme heat, flooding, wildfires – Colorado’s formerly incarcerated people on the hazards they faced behind bars  ‘The geezer game’ – a nearly 50-year-old pickup basketball game – reveals its secrets to longevity

‘The geezer game’ – a nearly 50-year-old pickup basketball game – reveals its secrets to longevity  Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report

Wall Street Rebounds as Investors Eye Tariff Uncertainty, Jobs Report  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns  Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day

Trump Draws Cheers at Ryder Cup as U.S. Trails Europe After Opening Day