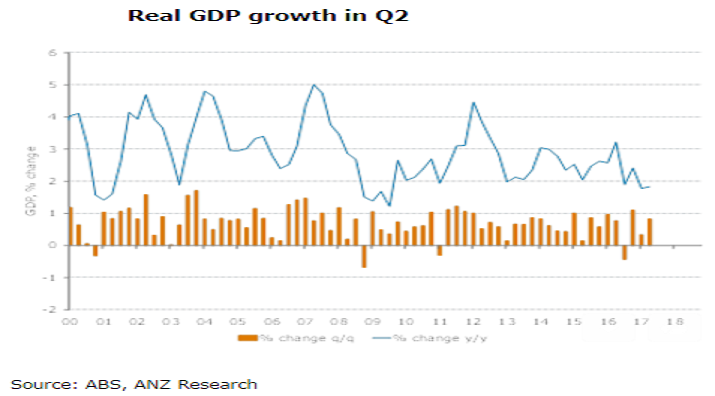

Australia’s gross domestic product (GDP) for the second quarter of this year rose a solid 0.8 percent q/q in Q2, leaving annual growth unchanged at 1.8 percent. Growth was supported by a strong gain in public spending, moderate household consumption and a small contribution from net exports. However, wages and inflation measures remain soft.

The public sector was the main driver of growth, with a strong rise in both public consumption and investment. The strength in private demand came from a solid (but unspectacular) rise in household consumption (+0.7 percent q/q) and a modest rise in business investment. Housing eked out a small gain, as flagged by the Construction Work Done Survey; and net exports added 0.3ppts to growth despite the hit to coal exports from Cyclone Debbie.

On the income side of the accounts, the numbers were relatively soft, with the wages bill growing only 0.7 percent q/q, compared with the 1.2 percent reported in the Business Indicators release on Monday; while profits fell a sharp 4.3 percent. Nominal GDP fell 0.1 percent, dragged down by the 6.0 percent drop in the terms of trade.

This week’s RBA statement and Governor Lowe’s speech last night suggest that the RBA is becoming increasingly confident with the trajectory of the economy in terms of activity and the labour market although it rightly sees the consumer as a risk and would be disappointed with the ongoing weakness in wage growth.

"For policymakers, these numbers should provide some encouragement on the growth front but little on the inflation front. For this reason, we remain comfortable with our view that the Bank will keep the cash rate on hold at least until end-2018," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves