China’s exports and imports data surprised negatively in April, suggesting that China’s export growth momentum is likely to soften in Q2. Data released earlier on Monday that China’s exports in April rose 8 percent year-on-year in dollar terms, while imports rose 11.9 percent. Both exports and imports missed expectations for a 10.4 percent rise in exports and a 18 percent jump in imports.

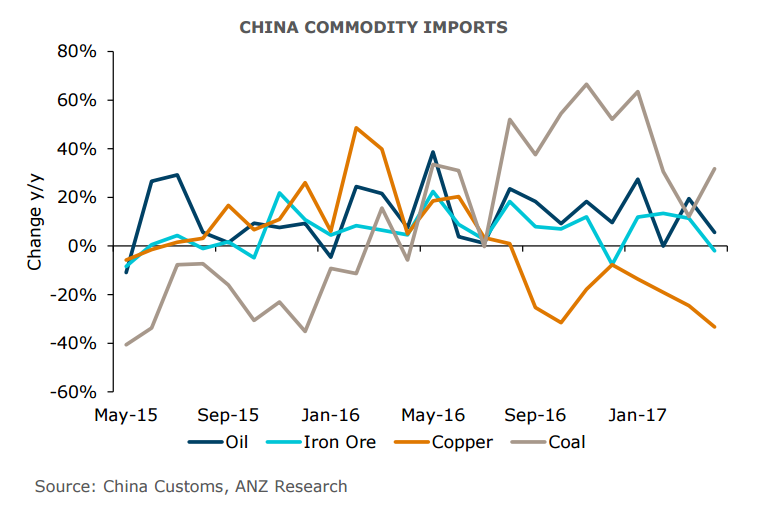

Softer domestic demand is denting imports into the country. The slowdown in imports growth in April is also attributable to the softening commodity price growth in the month. Year-on-year growth of global oil prices and domestic iron ore prices slowed sharply compared with previous months, playing a key role in dragging import growth in April lower. China's new export orders sub-index dropped to 50.6 in April after having improved for three consecutive months.

"Looking ahead, we expect export growth to hold up well given the relatively bright outlook for the global economy this year. Growth in inbound shipments will continue to face headwinds, however. In particular, policy tightening will further weigh on domestic demand in coming quarters, with the impact on import values amplified by declines in commodity prices," said Julian Evans-Pritchard, China economist at Capital Economics.

That said, China's trade balance surplus came in wider than expected in April. The country's trade surplus in April was $38.05 billion, higher than the projected $35.5 billion by Reuters and compared to a $23.93 billion reported in March. The trade surplus in yuan was 262.3 billion. Details of the report showed China's trade surplus with the United States widened to $21.34 billion in April compared with March's $17.74 billion surplus.

"The US ISM manufacturing PMI also declined to 54.8 in April from 57.2 in March. We think these may signal a softening momentum in China’s export growth in Q2 although the pipeline of electronic products in the global supply chain is still likely to keep China’s export outlook stable through 2017," said ANZ Research in a report.

Upbeat Chinese headline trade balance data provided an initial boost to the kiwi, but the Aussie remained largely muted. NZD/USD jumps to hit fresh multi-day tops at 0.6945, while, AUD/USD was down 0.21 percent at 0.7399 at around 1200 GMT. USD/CNY was largely unchanged at 6.9029.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength