China’s January inflation figures beat expectations and surprised the market on the upside. Data released by China’s National Bureau of Statistics on Tuesday showed China's headline consumer price inflation accelerated in January, largely because of the Lunar New Year and base effects. January's headline inflation rose to a three-year high of 2.5 percent year-on-year, as compared with December’s 2.1 percent and beating expectation of 2.4 percent. On a month-on-month basis, the headline inflation rose 1 percent as compared with the 0.2 percent rise in December.

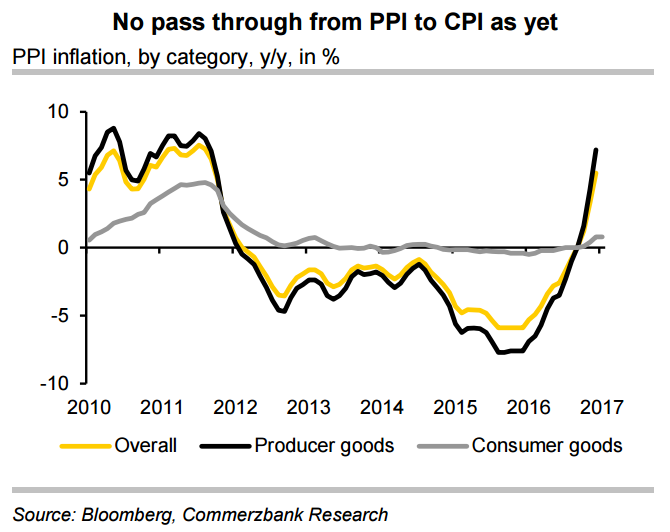

In the meantime, producer price inflation continued with its uptrend, rising sharply to 6.9 percent year-on-year in January from December’s 5.5 percent and beating consensus for 6.5 percent. PPI rose to the highest level in five years in January. However, on a sequential basis, the producer price inflation growth moderated in January. This implies that the inflation momentum might not be as solid at the first glance.

The strong rebound in PPI inflation is largely attributable to proactive fiscal policies at the local-government level, massive speculation in commodity futures market and efforts by authorities to cut overcapacity. Local governments are keen to deliver decent growth figures ahead of Chinese Communist Party's (CCP) 19th Congress late this year. China's infrastructure investment pipeline will remain solid in the next few quarters, and this will provide continual support for the outlook of the upstream commodity prices. Also, efforts by authorities to cut overcapacity in specific sectors have supported the prices of producer goods as well.

Analysts are skeptical about the continuance of inflationary pressure. Strength producer price inflation may moderate in coming months as Donald Trump’s policies add uncertainties to the global demand outlook. In the absence of strong demand, producers have limited space for price hikes. That said, we have not seen significant pass-through effect from PPI to CPI inflation as yet.

"We believe that the rebound in China’s PPI inflation is a complex story. It is still too early to conclude that China’s CPI inflation will pick up meaningfully in the future as there is little evidence of pass-through effects. More importantly, the absence of a pass-through may also indicate that we have yet to see any solid improvement in the economic fundamentals," Commerzbank wrote in a report.

The People’s Bank of China (PBoC) seems to have gradually shifted to a tightening bias, but the Chinese economy is not strong enough to offset any broad tightening. Danske Bank expects a peak in PPI inflation soon as well as a moderate slowdown in growth to keep the PBoC's tightening cycle short. Danske bank expects two hikes in official policy rates of 25bp over the next two quarters.

Chinese yuan appreciated on robust CPI data. USD/CNY made an intraday high of 6.8867 and low of 6.8624. At 1055 GMT the FxWirePro's Hourly Strength Index of Chinese yuan was slightly bearish at -55.7201, while Hourly Strength Index of US Dollar was slightly bullish at 88.4063 . For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate