After exiting a $19.5 billion joint venture with Vedanta, Foxconn revealed intentions to utilize India's $10 billion Modified Programme for Semiconductors and Display Fab Ecosystem, aiming to establish a thriving semiconductor manufacturing scene, a major blow to Prime Minister Narendra Modi's ambitions.

The multinational electronics manufacturer, acknowledged as the world's largest in its field, disclosed on Tuesday its efforts to apply for benefits under India's Modified Programme for Semiconductors and Display Fab Ecosystem. This $10 billion initiative offers incentives of up to 50% of capital costs for semiconductor and display manufacturing projects.

Foxconn has been actively assessing potential partners and remains committed to India's vision of establishing a thriving semiconductor manufacturing ecosystem. Despite the setback caused by the Vedanta breakup, the company plans to forge new alliances on its journey forward. Prime Minister Modi, who has placed great importance on chipmaking as a catalyst for a "new era" in electronic manufacturing, previously applauded the joint venture as a significant development.

Confidential sources reveal that Foxconn is currently discussing with various local and international entities, exploring the possibility of manufacturing semiconductors in India. These discussions focus on mature chip manufacturing technology and encompass a range of products, including electric vehicles (EVs). It is worth noting that the identity of these partners remains undisclosed.

Despite the dissolution of the partnership, Vedanta remains fully committed to its semiconductor project and has secured alternative partners to develop India's first foundry. The company has expressed unwavering determination to realize Modi's vision.

Sources familiar with the matter cited concerns about the delay in the approval of incentives by the Indian government as one of the contributing factors behind Foxconn's withdrawal. The government in New Delhi raised questions regarding the cost estimates submitted to seek incentives. These factors collectively led to Foxconn's exit from the venture.

Chipmaking is paramount to India's economic strategy, and Modi has endeavored to attract foreign investors to establish local chip production facilities for the first time. While India is a late entrant to the global chip manufacturing landscape, this ambitious project aimed to transform the country's electronics manufacturing industry. According to industry projections, India's semiconductor market is expected to reach $63 billion by 2026.

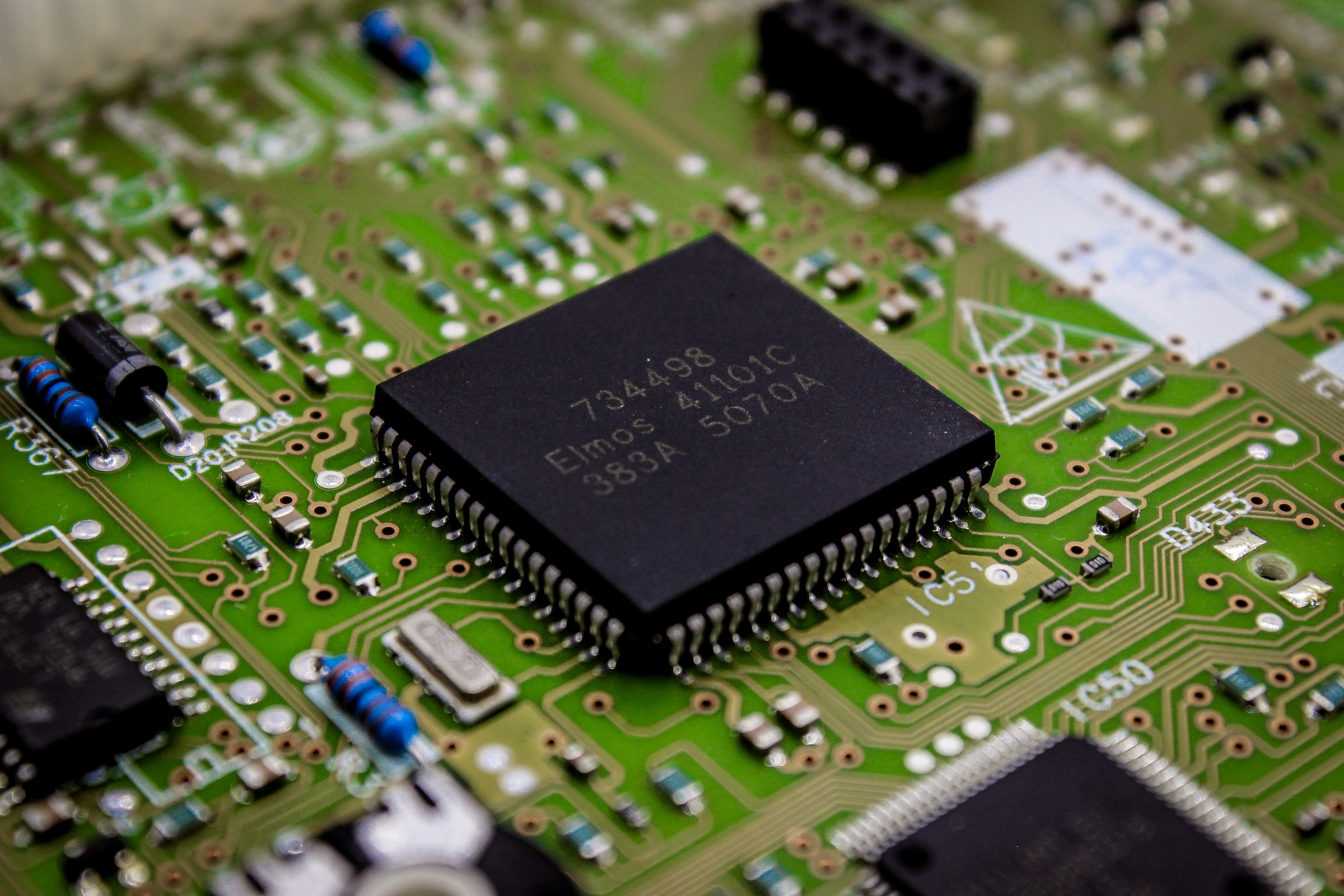

Photo: Bermix Studio/Unsplash

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO

Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision

SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Samsung Electronics Shares Jump on HBM4 Mass Production Report

Samsung Electronics Shares Jump on HBM4 Mass Production Report  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge