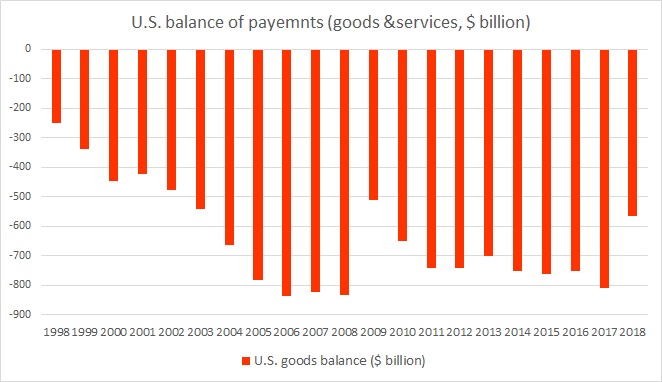

U.S. President Donald Trump’s name is now synonymous with the global trade war. President Trump has unilaterally waged a war against U.S trade deficits by forcing countries to engage in new trade negotiations with the United States. He also delivered his promise of tax cuts to the U.S. economy. However, while the effects of his policies are quite visible in the strength of the U.S. GDP growth, U.S. manufacturing sector, it is still absent in the trade numbers.

President Trump successfully negotiated a new trade agreement with several countries like China, Mexico, and Canada and has also imposed tariffs on several imports like Steel and Aluminum with additional tariffs on Chinese goods worth $250 billion.

However, the effect is still not visible in hard numbers.

In August, the United States’ goods trade deficit hit the widest on record of $75.46 billion and in 2018, it has already reached $565.6 billion. At this pace, the United States would record the widest trade deficit ever. The deficit is projected between $840-850 billion.

After so much of a trade and tariff war, a failure to curb the deficit would prove to be dollar negative. Since trade numbers take a lot to reflect the changes, we suggest waiting out 2019, since higher tariffs on Chinese goods would begin from January.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data