In its latest stimulus measure, the Morrison government will extend its first home loan deposit scheme to an extra 10,000 home buyers.

But unlike existing arrangements, where people can purchase a new or existing home, these buyers will have to build a house or buy a newly-built property.

The condition is to direct maximum help to the residential building sector.

As with the existing program, the extended program allows people to buy with a deposit of as little as 5%, much less than the usual deposit of about 20%. The government guarantees the other 15% of the deposit.

The additional guarantee will run until June 30, 2021. The program has already assisted some 20,000 buyers since the start of the year.

Treasurer Josh Frydenberg said: “Helping another 10,000 first home buyers to buy a new home … will help to support all our tradies right through the supply chain including painters, builders, plumbers and electricians.

"In addition to the government’s HomeBuilder program, these measures will support residential construction activity and jobs across the industry at a time when the economy and the sector needs it most.

"At around 5% of GDP, our residential construction industry is vital to the economy and our recovery from the coronavirus crisis.”

The first home loan deposit scheme began in January, to provide up to 10,000 guarantees for the financial year to June 30, 2020. It saw strong demand in its first six months , with 9,984 out of a maximum of 10,000 guarantees offered.

Between March and June, the scheme supported one in eight of all first home buyers.

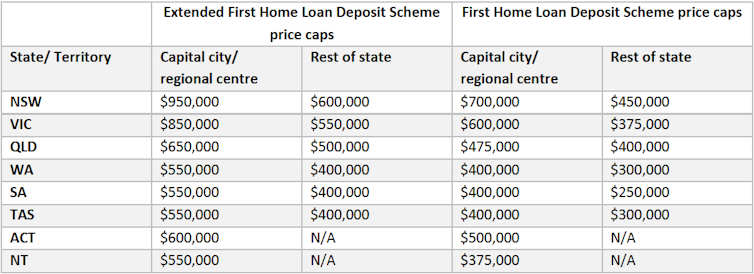

The government has announced new caps for the scheme, given newly built homes are usually more expensive than existing homes for first home buyers:

Michelle Grattan ne travaille pas, ne conseille pas, ne possède pas de parts, ne reçoit pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'a déclaré aucune autre affiliation que son organisme de recherche.

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances