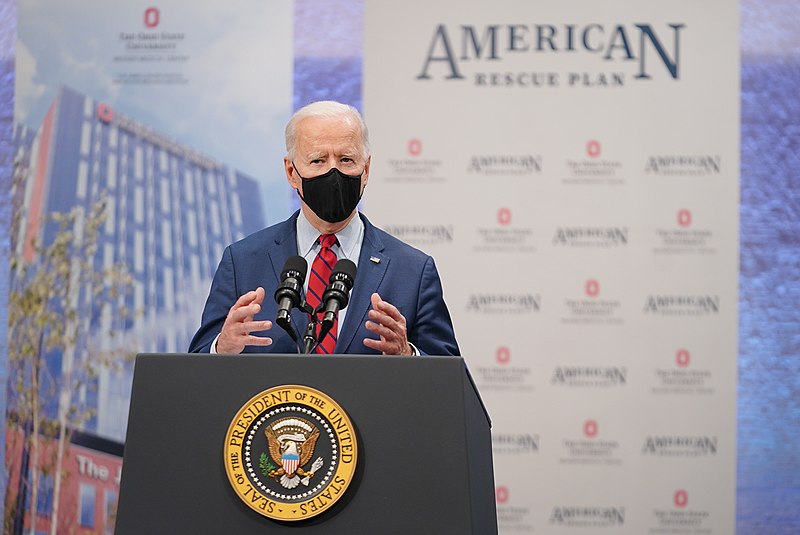

With the passage of the $1.9 trillion COVID relief proposal, the plan aims to cut child poverty in half. President Joe Biden announced that the child tax credit payments to families will begin by July.

The White House released a short statement from Biden regarding the provision of the plan, which looks to cut child poverty in half. Biden also urged Congress to pass his American Families Plan that will see the expansion of the child tax credit. Biden’s statement comes after the announcement made by the US Treasury, that Americans with children may begin to receive their child tax credit payments starting July 15.

“With today’s announcement, about 90% of families with children will get this new tax relief automatically, starting in July. While the American Rescue Plan provides for this vital tax relief to hard-working families for this year, Congress must pass the American Families Plan to ensure that working families will be able to count on this relief for years to come,” said Biden in the statement.

Almost 88 percent of children are going to receive the benefits without the need for their parents to take any additional action. Qualified families will be able to receive up to $300 a month for each child under six years old and $250 for children between six to 17 years old. The child tax credit was previously capped at $2000 and was originally only paid out to families that have income tax obligations.

However, for 2021, couples that earn less than $150,000 can receive the full payments every 15th of the month, mostly in direct deposits. Annually, the benefits for children under six years old amount to $3600 and for children between 6 to 17 years old, $3000.

In other news, Biden has continued with the tradition of presidents publicizing their financial records. Biden and first lady Dr. Jill Biden released their tax returns for 2020, the couple making over $600,000 and paid $157,414 of income tax. This amounts to a 25.6 percent federal income tax rate for the Bidens.

The Bidens also paid $28,794 in income taxes to their home state of Delaware. They were also reported to having donated $30,704 to 10 different charities.

New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.

Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Bangladesh Election 2026: A Turning Point After Years of Political Suppression

Bangladesh Election 2026: A Turning Point After Years of Political Suppression  Israel Approves West Bank Measures Expanding Settler Land Access

Israel Approves West Bank Measures Expanding Settler Land Access  Japan’s Prime Minister Sanae Takaichi Secures Historic Election Win, Shaking Markets and Regional Politics

Japan’s Prime Minister Sanae Takaichi Secures Historic Election Win, Shaking Markets and Regional Politics  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Antonio José Seguro Poised for Landslide Win in Portugal Presidential Runoff

Antonio José Seguro Poised for Landslide Win in Portugal Presidential Runoff  Trump Slams Super Bowl Halftime Show Featuring Bad Bunny

Trump Slams Super Bowl Halftime Show Featuring Bad Bunny  China Overturns Death Sentence of Canadian Robert Schellenberg, Signaling Thaw in Canada-China Relations

China Overturns Death Sentence of Canadian Robert Schellenberg, Signaling Thaw in Canada-China Relations  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit

Sydney Braces for Pro-Palestine Protests During Israeli President Isaac Herzog’s Visit  Bosnian Serb Presidential Rerun Confirms Victory for Dodik Ally Amid Allegations of Irregularities

Bosnian Serb Presidential Rerun Confirms Victory for Dodik Ally Amid Allegations of Irregularities  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition

Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition