Wall Street remains cautious as global headlines shake up markets. The fatal shooting of UnitedHealth’s CEO, Brian Thompson, a prominent leader in the U.S. health insurance industry, is one of the most shocking events of the day. Thompson was killed in New York City Wednesday in what police believe was a premeditated attack. The tragic incident has cast a shadow over the markets, particularly as investors digest the news and anticipate possible disruptions in the healthcare sector.

Thompson, who had been at UnitedHealth since 2004 and became the CEO of its insurance division in 2021, was in New York for an investors' meeting when the attack occurred. According to police, the killing was not random, and the motive appears to be targeted. Thompson's wife, Paulette, revealed that he had received threats related to his work, although the exact nature of those threats remains unclear.

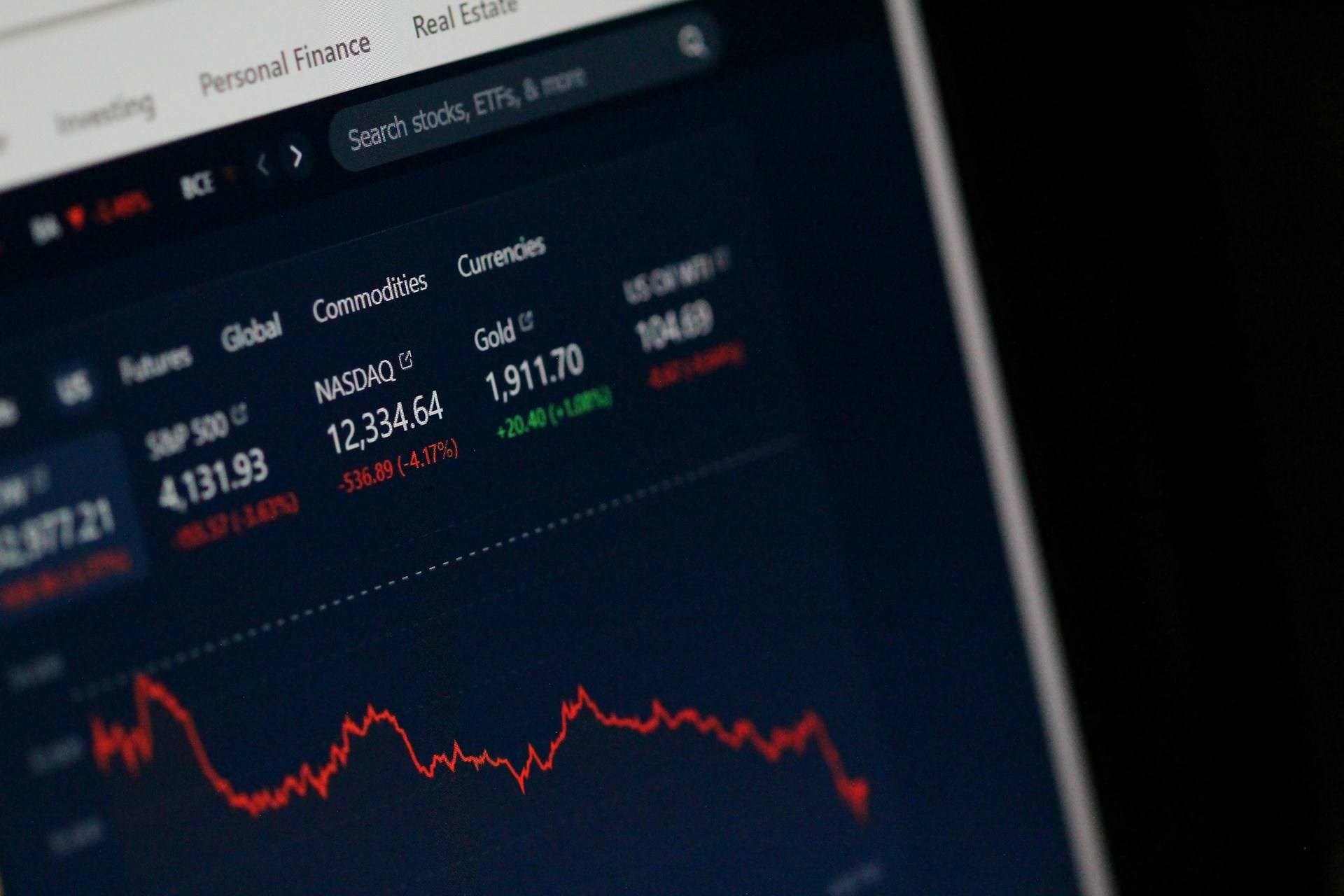

As investors grapple with the news of Thompson’s death, Wall Street futures showed little movement on Thursday. U.S. stock futures were constrained within tight ranges as traders awaited more economic data, including jobless claims and the highly anticipated jobs report on Friday. Despite the tragic news, the broader markets have managed to remain resilient, driven by optimism regarding the strength of the U.S. economy and corporate earnings. Stocks had closed at new record highs the previous day, following Federal Reserve Chair Jerome Powell's comments on the economy's strength.

In other global developments, Bitcoin surged past the $100,000 mark, reaching a new high as traders reacted to President-elect Donald Trump’s recent nomination of Paul Atkins as the new head of the U.S. Securities and Exchange Commission. Atkins, who has shown support for cryptocurrencies, is expected to replace the current SEC Chair, Gary Gensler, in January. The move is seen as a positive signal for the cryptocurrency market, which has struggled with regulatory uncertainty in recent years.

Meanwhile, the oil market is seeing subtle shifts. Prices for U.S. crude oil ticked upward following reports of a significant draw in U.S. inventories. Oil traders are also keeping an eye on an upcoming OPEC+ meeting, where the group is expected to discuss extending production cuts to maintain price stability. Shell and Equinor also announced a joint venture to form the largest independent producer in the U.K. North Sea by 2025, adding further intrigue to energy market dynamics.

However, the most unsettling news comes from France, where Prime Minister Michel Barnier is expected to resign following a vote of no-confidence. The resignation comes after a bitter clash over a controversial budget aimed at addressing a growing deficit. The political fallout from Barnier’s departure is expected to create uncertainty in French markets and could destabilize the broader European Union. The timing is especially critical as the EU faces multiple challenges, including political turmoil in Germany and financial instability in several member states.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm