FxWirePro: A glimpse through FX gamma impact in Q2’2018 after recent macroeconomic developments

Apr 02, 2018 06:32 am UTC| Research & Analysis Insights & Views

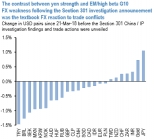

Q12018 began with an accelerated unfolding of our anticipated baseline themes for 2018 broad dollar weakness, policy repricing driving strength in non-dollar reserve and European currencies, and synchronized global...

Mar 29, 2018 13:02 pm UTC| Research & Analysis Insights & Views

The high uncertainty about the political future of Brazil is not putting pressure on BRL at present. The generally positive market sentiment as well as the credible monetary policy support BRL. If these framework...

Mar 29, 2018 12:43 pm UTC| Research & Analysis Insights & Views Central Banks

In this write-up, we emphasize on staying short in USDCHF spot trades and short EURCHF put options. USDCHF turned elegantly lower towards the end of the week when the dollar lost ground against other reserve currencies in...

Mar 29, 2018 10:44 am UTC| Research & Analysis Insights & Views

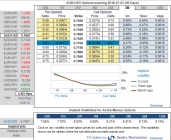

AUDUSD near-term momentum appears to be negative, targeting the 0.7650 areas if the USD rebound persists. Optimism over global growth remains intact though US-driven trade tensions pose downside risks to global trade...

Mar 29, 2018 08:20 am UTC| Technicals Insights & Views

Chart and candlestick pattern formed: Minor trend slides through falling wedge and intermediate trend in rising channel. Back-to-back shooting stars pop-up at wedge resistance and the bearish engulfing pattern has...

Mar 29, 2018 07:30 am UTC| Research & Analysis Central Banks Insights & Views

The currency markets navigated two major events over the past week that left the broad dollar with no more directional clarity than before. The March FOMC under new Fed Chair Powell raised rates as widely anticipated and...

Mar 29, 2018 06:11 am UTC| Digital Currency Technicals Insights & Views

Both minor and intermediate trends of BTCUSD has been weaker as the current price of this pair has slid below DMAs EMAs and the closing prices from last three days have remained below $8000 mark. As shown on the daily...

- Market Data