FxWirePro: Swiss foreign reserve surges as SNB banks on the ECB to pave the way

Mar 20, 2017 10:24 am UTC| Central Banks Insights & Views

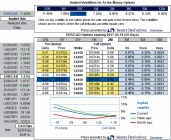

As the market gradually adjusts to the idea of policy tightening by the ECB, it is useful to consider the options ahead for the Swiss National Bank (SNB). Switzerland is entirely enclosed by the euro area, which is its...

Mar 20, 2017 09:42 am UTC| Central Banks Research & Analysis Insights & Views

The statement from BoCs March 1st meeting reiterated the point that, unlike the US, Canada was an economy that continues to be beset by material excess economic slack, and thus warrants a policy stance that remains very...

Why coca leaf, not coffee, may always be Colombia's favourite cash crop

Mar 20, 2017 02:45 am UTC| Insights & Views Economy

Colombias current peace process is facing numerous challenges. In a country that has suffered the worst impacts of the international drug war, one main dilemma is this: what to do with rural regions which have specialised...

Boards must do more to stamp out wrongdoing that damages trust in charities

Mar 20, 2017 02:18 am UTC| Insights & Views Law

When you put $20 in the charity collectors can at the traffic lights, you trust that it goes to the people the charity was set up to help. But how do you know if this is actually the case? The vast majority of donations...

Government cracks down on secret company payments to unions

Mar 20, 2017 01:57 am UTC| Insights & Views Law

The government has announced legislation to ban secret payments between employers and unions, with companies facing criminal penalties of up to A$4.5 million for breaches when the payment could have a corrupting...

Can Silicon Valley's autocrats save democracy?

Mar 20, 2017 01:54 am UTC| Insights & Views Politics

In late February, Facebook founder and CEO Mark Zuckerberg published an essay that laid out the social networks vision for the coming years. The 5,700-word document, immediately dubbed a manifesto, was his most...

Could Roe v. Wade be overturned?

Mar 20, 2017 01:50 am UTC| Insights & Views Law

If you care about the future of abortion rights, now is a good time to worry. A sweeping Supreme Court victory for pro-choice advocates last summer was quickly overrun by worries brought on by the election of Donald...

- Market Data