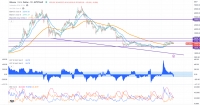

FxWirePro: AUD/NZD slips lower from session highs, recovery lacks traction

Mar 08, 2023 12:44 pm UTC| Technicals

Chart - Courtesy Trading View AUD/NZD was trading 0.17% higher on the day at 1.0788 at around 12:30 GMT, down from session highs at 1.0811. The pair is consolidating previous session slump, where it closed 0.78%...

FxWirePro- Currency Strength Index (4- Hour chart)- Currency pairs to watch (USDCAD) for the day)

Mar 08, 2023 12:07 pm UTC| Technicals

Pair Value Recommendation USDCAD 326.50 Strong Sell USDCAD Major resistance- 1.3810 Near-term support- 1.3680 Trend reversal level- 1.3650 Above (-150):Sell Above...

FxWirePro: EUR/CHF pauses 4-day bearish streak, 55-EMA offers strong support

Mar 08, 2023 12:01 pm UTC| Technicals

Chart - Courtesy Trading View Technical Analysis: - EUR/CHF was trading 0.13% higher on the day at 0.9934 at around 11:20 GMT - The pair has paused 4-day bearish streak, finds strong support at 55-EMA - 5-DMA...

Mar 08, 2023 10:19 am UTC| Technicals Digital Currency

BTCUSD showed a minor sell-off after Powells testimony. He said that Fed will go for more rate hikes than anticipated. It has decreased demand for riskier assets like Crytpo. The US government has transferred 40000 Bitcoin...

FxWirePro- USDCAD Daily Outlook

Mar 08, 2023 09:17 am UTC| Technicals

Intraday bias - Bullish USDCAD jumped sharply after the hawkish Powell testimony. It shows that Fed is likely to increase rates more than anticipated. Fed chairman said that the central bank is also prepared to...

FxWirePro: NZD/USD Daily Outlook

Mar 08, 2023 08:14 am UTC| Technicals

Chart - Courtesy Trading View Spot Analysis: NZD/USD was trading 0.11% higher on the day at 0.6111 at around 08:05 GMT. Previous Weeks High/ Low: 0.6275/ 0.6131 Previous Sessions High/ Low: 0.6221/...

FxWirePro- EURUSD Daily Outlook

Mar 08, 2023 08:04 am UTC| Technicals

Ichimoku analysis (4-hour chart) Tenken-Sen- 1.06093 Kijun-Sen- 1.06093 EURUSD pared most of its gains and lost more than 150 pips on the hawkish Powell speech. It shows that Fed is likely to increase...

- Market Data