Almost all market infrastructure (MI) providers in capital markets are involved in the development of distributed ledger technology (DLT) projects through partnerships, joint ventures, and industry consortia, a new study has revealed.

Nasdaq, in collaboration with Celent, has recently released a report on “CIO Priorities In Capital Markets Infrastructure,” which focuses on three important trends: the factors that are driving changes in MI, how MIs are using technology to support business strategies and how technology spend is evolving. The report was conducted through a survey of C-suite executives representing 20 different MI organizations across North America, Europe, Middle East, Asia, and Latin America.

Among other cutting-edge technologies, the report focuses on DLT which, it says, “promises to be transformative, especially in post-trade market infrastructure.”

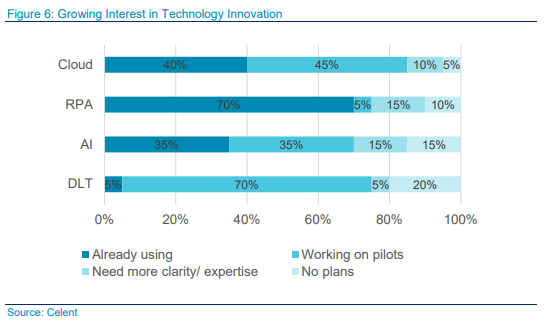

According to the report, while numerous DLT use cases are emerging in peripheral functions, the technology’s complexity makes it difficult for MIs to experiment with it individually. The survey results show that:

- 70 percent of MIs are involved in accelerators, pilots, or industry consortia

- Only 5 percent of MIs are already using the technology

- 20 percent of MIs have no plans to use DLT

- 5 percent of MIs need more clarity on DLT

“Some leading players have begun using DLT-based solutions in niche functions or smaller markets. A few post-trade players have developed DLT solutions in core functions, with one player mentioning its solution has been tested with market participants, but cannot go into production because regulators are not ready yet. The leaders in this space are offering blockchain platforms for creating electronic marketplaces in non-financial services industries,” the report said.