For now, its' a make or break situation on euro's perspective because of the following driving forces:

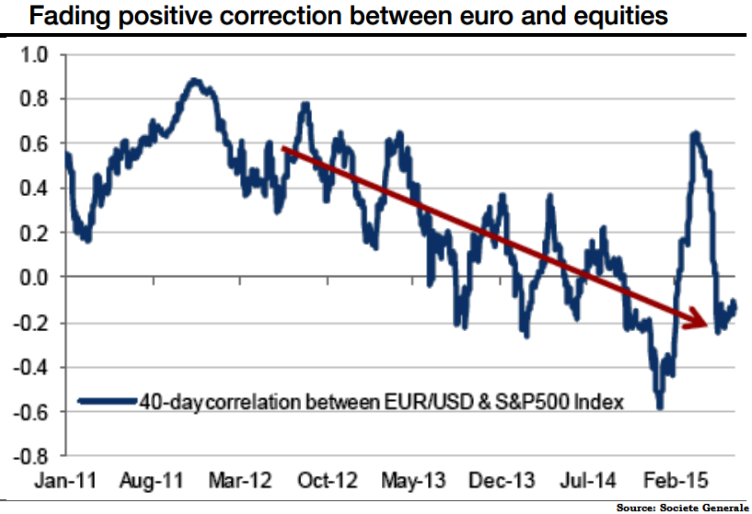

- The correlation between EUR/USD and risk appears to have melted away this year (Please refer above chart).

- While usually positive performing nations like France and Germany in euro zone have shown sluggish numbers in trade balance and factory orders. French trade balance reported an expansion of -4.0 billion from previous -3.3 billion and German factory orders have reached negative territory at -0.2%.

- We still like short EUR/USD but a likely Grexit (and Greece's attempts to prevent Grexit by securing more funding) and the resulting market turbulence could nudge the Fed into a more cautious stance.

This uncertainty from Fed's side can be deemed as hugely impacting on US businessmen and also on dollar's strength as well.

For EUR/USD, while formulating hedging framework with the pair continuing its upside correction, we still hold a 2M 1.05 target for EURUSD (based partly on our non-consensus house view that the Fed will hike in September). So such hedging perspectives may not imply in case of Fed's rate hike decisions to defer it to Christmas seasons. We come up with long term hedging strategies in our upcoming write ups.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary