ADP employment data to be released at 13:15 GMT is today’s most vital dockets from US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Previous performance –

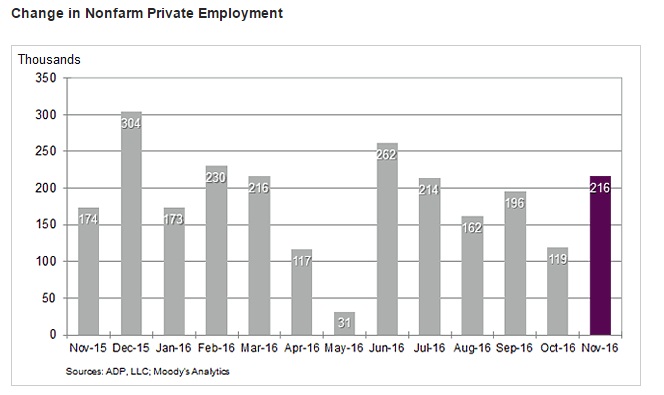

- Non-farm private sector employment grew at 216,000 in November. In October payroll grew by 119,000.

- Small business sector hiring at 37,000.

- Employment in franchise increased by 15,100.

- 10,000 jobs lost in the manufacturing sector.

- 11,000 jobs were lost in the goods-producing sector.

- Construction sector added 2,000 jobs.

- 12,000 jobs were added in financial activities.

- Services sector remains the major job provider. Payroll added 228,000 people in October.

Expectation Today –

- The headline number is expected to rise to 173,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and rate hike bets are likely to rise once more, providing support to the already rising dollar.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and investors would have to consider their rate hike outlook.

However, there may not be much volatility surrounding the report, as the focus would be on the NFP report on Friday. The dollar index is currently trading at 102.91, down a quarter percent for the day so far.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals