ADP employment data to be released at 13:15 GMT is today’s most vital dockets from US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Previous performance –

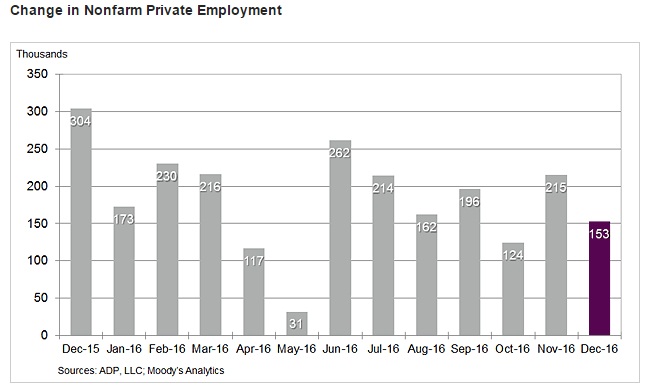

- Non-farm private sector employment grew at 153,000 in December. In November payroll grew by 215,000.

- Small business sector hiring at 18,000.

- Employment in franchise increased by 23,300.

- 9,000 jobs lost in manufacturing sector.

- 16,000 jobs were lost in goods producing sector.

- Construction sector lost 2,000 jobs.

- 10,000 jobs were added in financial activities.

- Services sector remains the major job provider. Payroll added 169,000 people in December.

Expectation Today –

- Headline number is expected to rise to 165,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and rate hike bets are likely to rise once more, providing support to the already rising dollar.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and investors would have to consider their rate hike outlook.

However, there may not be much volatility surrounding the report, as the focus would be on the NFP report on Friday. The dollar index is currently trading at 99.7, up 0.14 percent for the day so far.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady