ADP employment data to be released at 12:15 GMT is today’s most vital dockets from the US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Previous performance –

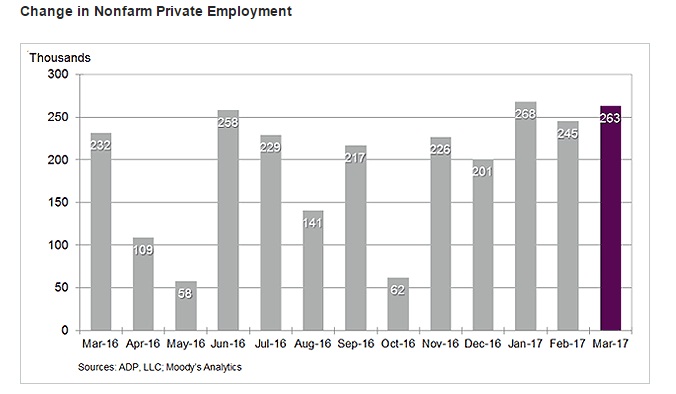

- Non-farm private sector employment grew at 263,000 in March. In February payroll grew by 245,000.

- Small business sector hiring at 118,000.

- Employment in franchise increased by 13,900.

- 30,000 jobs added in the manufacturing sector.

- 82,000 jobs were added in the goods-producing sector.

- Construction sector added 49,000 jobs.

- 25,000 jobs were added in financial activities.

- Services sector remains the major job provider. Payroll added 181,000 people in March.

Expectation Today –

- The headline number is expected to decline to 180,000 as per median estimate.

Market Impact –

- Any gain above 230,000 will be considered to be very good and the US stock market would rise further on risk-affinity.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and doubts would emerge on manufacturing revival under Trump.

However, there may not be major moves on ADP as FOMC is scheduled later in the day. The dollar index is currently trading at 99.1, up 0.15 percent for the day.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal