WTI is sharply higher on hopes of global policy coordination.

Key factors at play in Crude market

- Venezuela's efforts seem to be bearing some fruits, Saudi Arabia and Russia have agreed to freeze production at January level. Further cooperation in likely.

- US lawmakers passed bill to lift 40 year oil ban on US crude export.

- Latest IEA report shows, supply demand imbalance likely to be larger than it had expected in 2016. Non-OPEC production likely to drop by 600,000 barrels in 2016 but that would be compensated by similar increase from Iran.

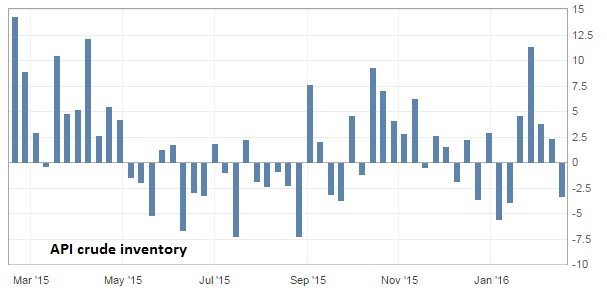

- American Petroleum Institute's (API) weekly report showed inventory dropped by 3.3 million barrels, first drop in five weeks.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 16:00 GMT.

Trade idea -

- We at FxWirePro remains committed to downside, price action suggests further drop in prices. Goldman Sachs has called for $20/barrel oil, while Standard Charted called for $10/barrel and EIA, $5/barrel.

- According to our calculations, next targets for oil are $22 and $20.3/barrel.

- WTI-Brent spread could widen over lower demand of US crude. It is currently at $2.5/barrel.

- However current price action suggest crude might push higher in the very near term.

- Price might rise towards $41/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed