WTI is sharply up this week following Brent, trading at $42.1/barrel at $3.1/barrel discount to Brent.

Key factors at play in Crude market -

- Saudi Arabia signaled this week that it might finally cooperate with both OPEC and non-OPEC producers.

- Middle East tensions rose as Turkey downed a Russian fighter Jet, accusing it of sovereign airspace violation, which Russia denied and said Turkey would face serious consequences.

- According to IEA it might take until 2020 for oil to reach $80/barrel.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

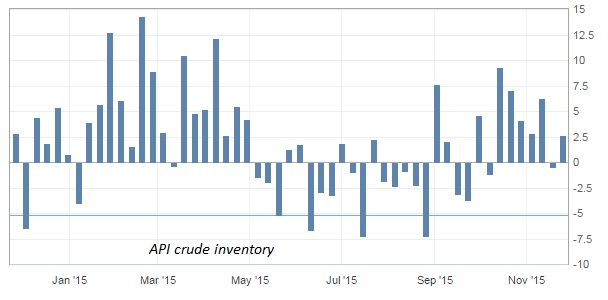

- American Petroleum Institute's (API) weekly report showed inventory rose by +2.6 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea -

- Though downward pressure and downtrend remains in place there could be further upside correction over Middle East tensions.

- We at FxwirePro remains committed to downside, however correction might extend to as high as $47/barrel.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand