Crude oil gained today. As of now, WTI benchmark is up around 1%, trading at $46.3/barrel.

Today's rise can be contributed to two factors -

- Bulls were successful to defend crucial support area at $45/barrel. Even if ETI moves down further, we might be looking at larger correction.

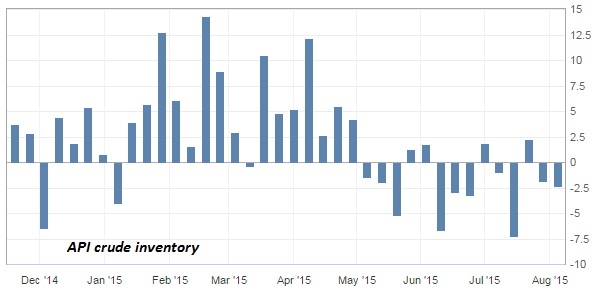

- American Petroleum Institute's (API) weekly report showed inventory depletion by 2.4 million barrels, which is suggesting similar depletion might be seen in EIA report.

Today's report might work as key catalyst for crude oil market, though focus is on NFP this week. Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Active Trade idea -

- Initial call was to sell crude around $60/barrel with stop loss at $63 and initial target at $50-51 area and $42/barrel as next and $46/barrel as interim target.

- Crude has reached all but last target. New positions can be entered if Crude succeeds to post a bounce back around $48-49/barrel area.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand