Crude oil jumped back, after initial loss over Chinese devaluation of Yuan/Dollar exchange rate. As of now, WTI benchmark is up around 1%, trading at $43.5/barrel.

Today's comeback can be contributed to four factors -

- WTI is looking to find some support around key level of $42/barrel. Today's low in crude oil is around $42.8/barrel.

- Weak Dollar providing some support to crude oil.

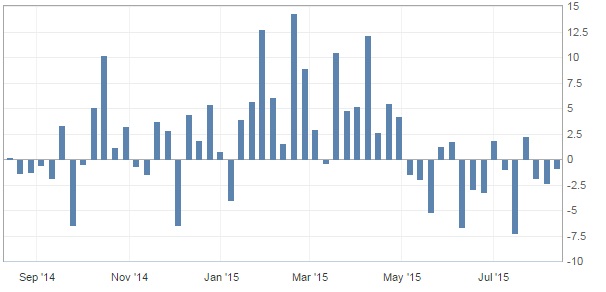

- American Petroleum Institute's (API) weekly report showed inventory depletion by 0.874 million barrels, which is third consecutive weekly drop.

- Saudi Arabia's production dropped by 0.2 million barrels/day in July.

Today's report might work as key catalyst for crude oil market, though it is unlikely to reverse the large bearish trend. Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Active Trade idea -

- Crude oil has almost reached the final target area at $42/barrel, though drop might extend below $40 area. Initial call was given around $63/barrel. Upon reaching targets, profit booking suggested on majority positions and move to wait and watch mode.

- For WTI, support lies at $42 area, while resistance is around $45 and $49/barrel.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings