Crude is at crucial juncture ahead of weekly inventory report.

WTI is trading at key support level, both technical and psychological at $50/barrel. Today's inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

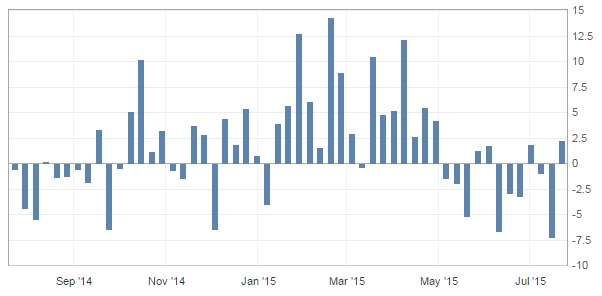

American Petroleum Institute (API) report showed that this week inventory rose by 2.3 million barrels, after a drop of 7.3 million barrels last week.

Trade idea -

- Initial call was to sell crude around $60/barrel with stop loss at $63 and initial target at $50-51 area and $42/barrel as next.

- It is advised to maintain position and new positions can also be added. For the previous and all new position stop loss should be maintained around $53.5-54/barrel.

- Target is coming around $42 area, however bears might even push prices towards $37 mark. Interim target is around $45-46/barrel, where bulls are expected to find support.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate