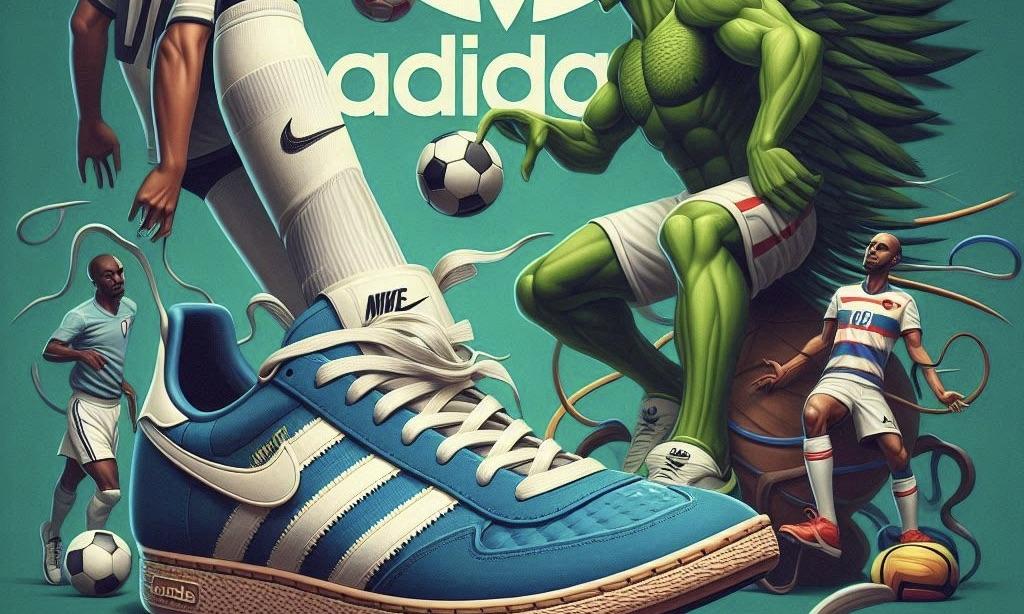

As Adidas capitalizes on the growing popularity of its Samba and Gazelle shoes, the brand is gaining market share from rival Nike. However, analysts caution that the trend’s longevity may wane, urging Adidas to manage its releases carefully to maintain consumer interest and prevent market saturation.

Adidas Projects Strong Q3 Growth, But Analysts Warn of Waning Samba Trend and Market Saturation

Due to its ongoing difficulties, Adidas is gaining market share from its more prominent U.S. rival, Nike. However, the German brand must exert additional effort to maintain consumer interest in its Samba and Gazelle terrace footwear.

Analysts anticipate that Adidas will report third-quarter revenues of 6.4 billion euros, a 10% increase in currency-adjusted terms from the previous year, when it reports earnings on Oct. 29. The shoes have contributed to the company's sales growth in the past year.

However, industry professionals predict that the Samba will not continue to be the "it shoe" for an extended period, despite the trend being in place for over a year.

"The sneakerheads, the more fashion-forward consumers, they already have the shoes. We're now looking at them (Adidas) milking the rest of the trend on the way down by introducing lower price points within the terrace," said Aneesha Sherman, an analyst at Bernstein.

"They can still get a tonne of growth out of that because there are still laggards who don't have these shoes yet or maybe didn't want to pay the $100 price point but are willing to pay a $60 price point," she added.

According to Reuters, Adidas has continued releasing new colorways for the Samba, Gazelle, and Spezial to appeal to consumers who desire to participate in the trend while still seeking a distinctive style. Some models feature tongues reminiscent of football boots and contrast stripes in novel materials such as velvet.

For the time being, this has satisfied third-party retailers such as J.D. Sports. During the half-year results on July 31, Adidas CEO Bjorn Gulden stated that the brand was still "chasing demand" from retailers.

"There's always this push and pull, the consumer wants more, retailers want more, but the brand has to step back and say we're going to dial this back to make sure we preserve it for a long time," said Matt Powell, sneaker industry expert and senior advisor at BCE Consulting.

"Adidas would be right to really tap the brakes on the Samba and Gazelle, to make sure they promote the sell-through," he said. Sell-through refers to the percentage of product a retailer sells after receiving it from a supplier.

Adidas Shifts Focus to New Models Like SL72 and Campus as Yeezy Demand Declines and Nike Struggles

There are indications that the brand is transitioning its focus to other shoes, such as the SL72 "retro running" sneaker and the Campus. Also, Stella McCartney's Paris Fashion Week show featured a new Adidas shoe inspired by motorsport racing shoes, which capitalized on the burgeoning trend surrounding Formula 1, which recently announced a 10-year partnership with luxury group LVMH.

Adidas can also rely on something other than the robust revenues and profits generated by its remaining stock of Yeezy footwear, as the demand for the shoes, designed by the disgraced rapper Kanye West, has declined. In August, Adidas mailed its footwear club members promoting discounts of up to 70% on Yeezys.

Nevertheless, Adidas has a distinctive opportunity to expand, particularly in the United States, where Nike is particularly dominant, and Adidas was heavily reliant on its Yeezy range. Nike has withdrawn its annual guidance and signaled a weak holiday trading season as a new CEO assumes the helm.

According to direct-to-consumer sales data from Consumer Edge, Adidas has gained market share in Europe over the past year, while Nike's share has decreased. Additionally, On Running, Puma, and Hoka have made substantial gains.

Sherman of Bernstein anticipates that Adidas will continue to expand its market share over the next year, as Nike will require time to improve its performance.

"It could change, if Nike were to put out a strong lifestyle shoe in the spring, and if that were to catch and gain some traction in the summer, we could see a shift - where the it shoes of summer 2024 were the Samba and Gazelle, the it shoe of next summer could be something from Nike," she said.

Columbia Student Mahmoud Khalil Fights Arrest as Deportation Case Moves to New Jersey

Columbia Student Mahmoud Khalil Fights Arrest as Deportation Case Moves to New Jersey  Stuck in a creativity slump at work? Here are some surprising ways to get your spark back

Stuck in a creativity slump at work? Here are some surprising ways to get your spark back  Heritage, desire and diplomacy: why China still values scotch whisky

Heritage, desire and diplomacy: why China still values scotch whisky  Disaster or digital spectacle? The dangers of using floods to create social media content

Disaster or digital spectacle? The dangers of using floods to create social media content  What’s the difference between baking powder and baking soda? It’s subtle, but significant

What’s the difference between baking powder and baking soda? It’s subtle, but significant  Why a ‘rip-off’ degree might be worth the money after all – research study

Why a ‘rip-off’ degree might be worth the money after all – research study  Yes, government influences wages – but not just in the way you might think

Yes, government influences wages – but not just in the way you might think  The ghost of Robodebt – Federal Court rules billions of dollars in welfare debts must be recalculated

The ghost of Robodebt – Federal Court rules billions of dollars in welfare debts must be recalculated  The pandemic is still disrupting young people’s careers

The pandemic is still disrupting young people’s careers  Office design isn’t keeping up with post-COVID work styles - here’s what workers really want

Office design isn’t keeping up with post-COVID work styles - here’s what workers really want  Parents abused by their children often suffer in silence – specialist therapy is helping them find a voice

Parents abused by their children often suffer in silence – specialist therapy is helping them find a voice  Why have so few atrocities ever been recognised as genocide?

Why have so few atrocities ever been recognised as genocide?  Why financial hardship is more likely if you’re disabled or sick

Why financial hardship is more likely if you’re disabled or sick  Locked up then locked out: how NZ’s bank rules make life for ex-prisoners even harder

Locked up then locked out: how NZ’s bank rules make life for ex-prisoners even harder