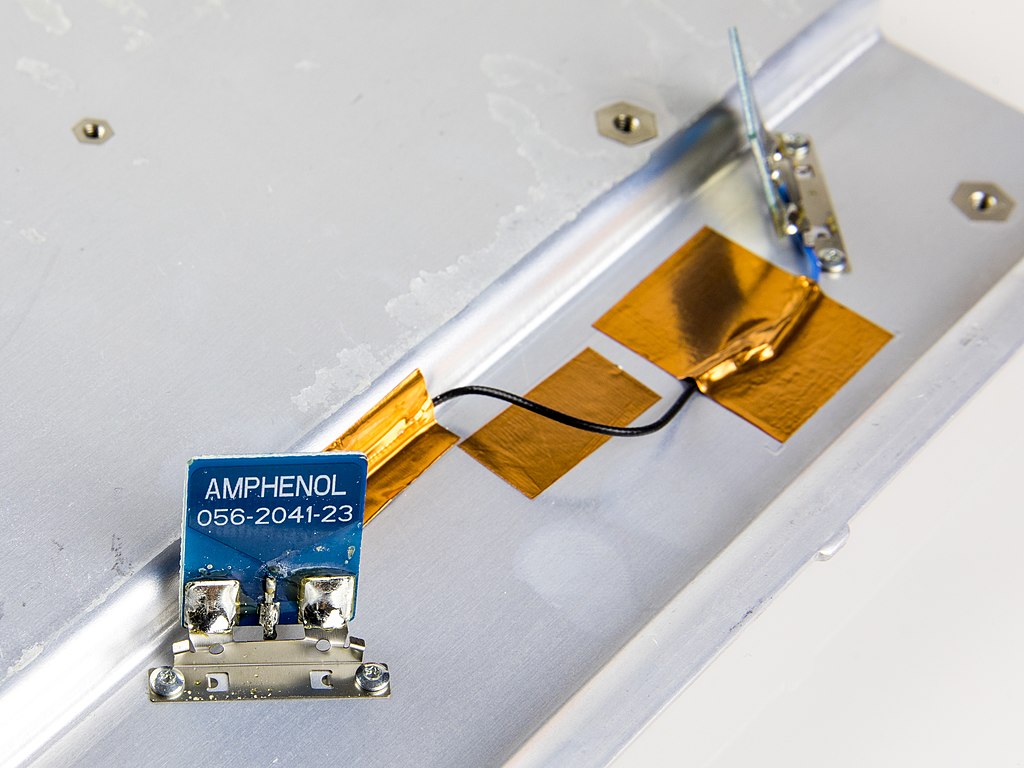

Amphenol Corporation (NYSE: APH) is reportedly close to acquiring CommScope’s (NASDAQ: COMM) broadband connectivity and cable business in a deal valued at about $10.5 billion, according to the Wall Street Journal. Sources familiar with the matter said the agreement could be finalized as early as Monday.

The acquisition would mark a significant expansion for Amphenol as it aims to capitalize on growing demand for data centers, which rely heavily on fiber-optic cables to deliver high-speed data transmission. Industry analysts note that the surge in cloud computing, streaming services, and AI-driven applications is driving infrastructure upgrades, boosting demand for broadband solutions.

CommScope’s broadband unit is its largest division by sales and operating income, making it a strategic asset in the global connectivity market. Earlier reports indicated that CommScope had been exploring a sale to reduce debt and refocus on its core business operations.

This would not be Amphenol’s first purchase from CommScope. In 2023, the company acquired CommScope’s outdoor wireless network and distributed antenna systems units for $2.1 billion, strengthening its position in the wireless infrastructure sector. The latest deal would significantly broaden Amphenol’s portfolio, positioning it as a stronger player in both wired and wireless communication markets.

If completed, the transaction would be one of the largest in the connectivity and infrastructure space this year, reflecting the industry’s ongoing consolidation trend as companies seek to meet escalating global data demands.

Both Amphenol and CommScope have yet to issue official statements regarding the reported deal.

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom