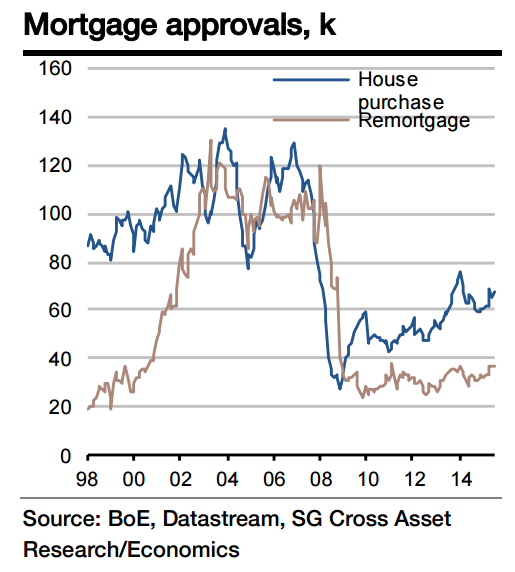

The Money and Credit release should show broad money growth (M4 exIOFCs) proceeding at a healthy pace of close to 4% 3mth p.a, more than enough to support a reasonable pace of activity growth. Net consumer credit growth should rise by another £1.2bn, consistent with a firm trend in retail sales, but mortgage growth is likely to remain far softer.

"The BBA approvals data showed an extremely modest increase and we expect that to be corroborated in the BoE data with a rise of only 0.6k from 68.8k to 69.4k", notes Societe Generale.

Another modest increase in UK mortgage approvals likely

Tuesday, September 29, 2015 12:27 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022