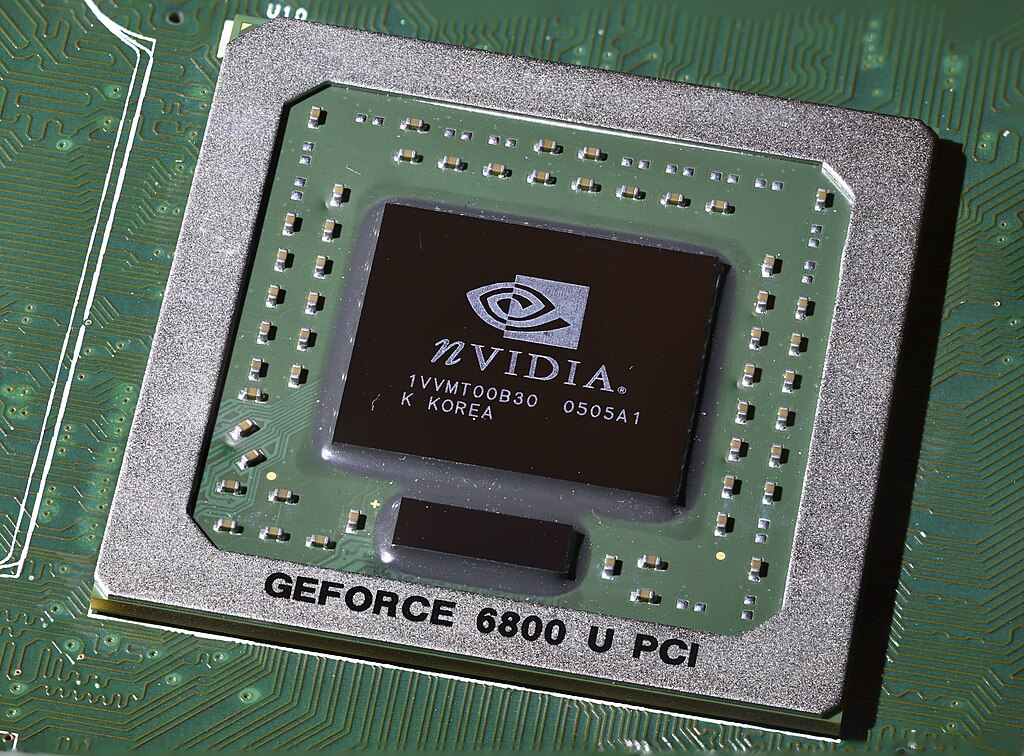

Asian markets edged higher on Tuesday as investors focused on U.S. trade talks, inflation data, and corporate earnings. The MSCI Asia-Pacific index outside Japan gained 0.4%, while Japan's Nikkei added 0.2%. Optimism was supported by Nvidia’s (NASDAQ: NVDA) plan to resume sales of its H20 AI chips in China, boosting Nasdaq futures by 0.5%.

The dollar held recent gains, trading at 147.62 yen, near a three-week high. The euro rebounded 0.1% to $1.1680 after a four-day slide. U.S. crude slipped 0.5% to $66.63 per barrel as President Donald Trump issued a 50-day ultimatum for Russia to end the Ukraine war or face expanded energy sanctions. Gold rose 0.6% to $3,363.40 per ounce, and silver hit a new high, trading at $38.25.

Trump also hinted at tariff flexibility following threats of imposing 30% duties on the EU and Mexico by August 1. The European Union warned of countermeasures, while Japan seeks high-level trade talks with the U.S. this Friday. Japanese Prime Minister Shigeru Ishiba, facing an election challenge, is expected to meet U.S. Treasury Secretary Scott Bessent in Tokyo.

In economic news, China’s Q2 slowdown was less severe than expected, signaling resilience amid tariffs. Japanese 10-year bond yields hit 1.595%, the highest since 2008, on political and economic uncertainty.

U.S. earnings season begins this week, with bank results closely watched. S&P 500 Q2 earnings are forecast to rise 5.8% year-over-year, down from 10.2% in April. Investors await U.S. June inflation data for further policy cues. Euro Stoxx 50, DAX, and FTSE futures were modestly higher, indicating a positive European open.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target