- BoJ's interest rate decision: The benchmark interest rate in Japan was last recorded at 0% which is unchanged from previous period and remains in line with consensus.

- Nikkei 225 index was almost flat (up 0.17%) ahead of the BOJ decision

- South Korea's Kospi is up about 0.3%

- Nifty is positive with 0.5% up

- Hang Seng gains 1.6%

Japan's Events today:

BOJ governor holds press conference today in which the BOJ uses to communicate with investors regarding monetary policy.

Japanese shares opened flat as investors await the latest policy decision from the Bank of Japan (BOJ), While Interest rate decisions were made by the Bank of Japan's Policy Board in its Monetary Policy Meetings.

Currency Derivatives Trade theme: (USD/JPY)

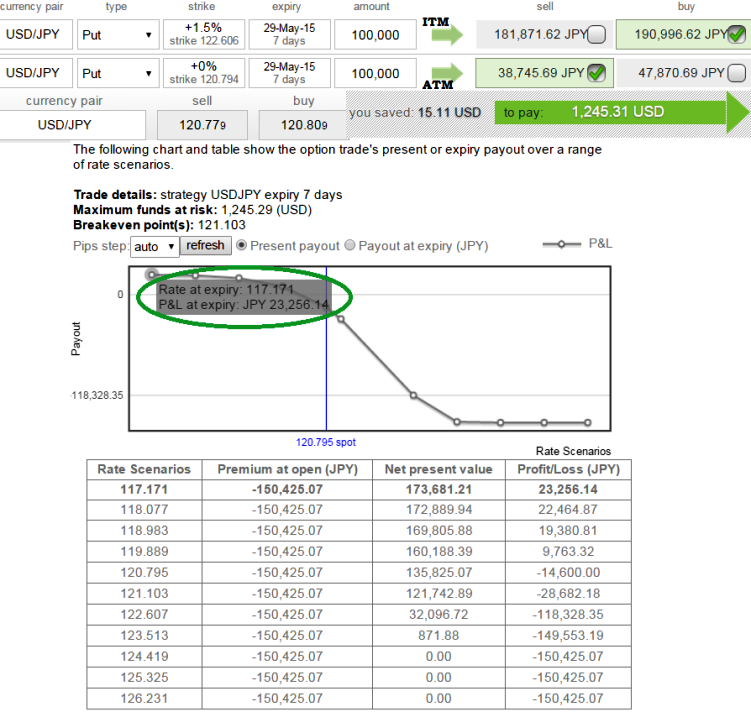

Option strategy: Bear Put Spread (BPS) or short JPY on futures

We continue to stick with our earlier recommendation,

Bear Put Spread = Protective Put (usually ITM or ATM) + Sell another Put with lower Strike Price (Out of the Money).

Bear Put Spread shall be used over Protective Put when the premiums on Protective Puts are too costlier.

Bear Put Spread reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

As it is a partial hedge strategy which only minimizes the loss if the underlying currency has to move lower but does not cap the loss.

The above chart explains how this strategy in a scenario evidences the different profitability at different intervals of exchange rates.

Shorting on near month futures can also be an alternative way.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand